Will The Sydney Market Collapse After JobSeeker and JobKeeper? - October 2020

October 8, 2020 / Written by Rich Harvey

By Rich Harvey, CEO & Founder, propertybuyer.com.au

If there’s one word that sums up the mood of 2020 so far it would easily be ‘uncertainty’.

The coronavirus pandemic has delivered plenty of that on the social, political and economic fronts, with the financial ramifications unlike anything we’ve seen in generations.

And while the recent budget will go a long way to stimulating employment through business support and tax breaks, a heavy cloud still hangs over those currently relying on government income assistance.

As a result, I’ve had some pretty sobering conversations with clients recently about what happens when packages like JobSeeker, for those who’ve lost their jobs, and JobKeeper, for businesses to keep people employed, run out.

People are understandably fearful about buying right now, especially when they switch on the evening news or open a newspaper.

So, will the property market in Sydney collapse?

Some commentators say they’re fearful of what lies ahead, but before we get too anxious, let’s look at what’s actually happened this year.

There’s no denying that things look dire. This is the economic downturn is the worst since the Great Depression and makes the Global Financial Crisis looks like a walk in the park. The government now has the biggest deficit ever, the worst quarterly slump in growth on record and an unemployment rate not seen in almost three decades.

Yet, property has defied all expectations at the same time.

Cast your mind back to March and April when the pandemic took hold in Australia and we began rapidly preparing for a near-total shutdown of everyday life.

Predictions were that property prices would collapse by 20 or 30 per cent, depending on the pundit who was being interviewed in the media. It was going to be a catastrophe unlike anything we’ve seen before.

Those very same pundits now peering into their crystal balls to offer their opinions on what’s around the corner had concluded that a mammoth crash was weeks away.

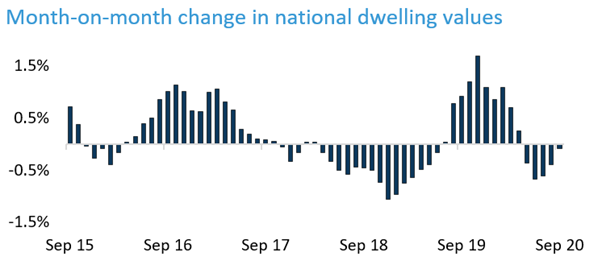

Source: CoreLogic

And sure, the month-on-month change in dwelling values at a national level is in negative territory. No one likes to see that.

But look at the same quarter two years ago during the market correction led by major cities like Sydney and Melbourne. It was considerably sharper than what we’re seeing now – and we’re in the midst of a once-in-a-century crisis.

Not quite the disaster that most people said we’d be dealing with by now.

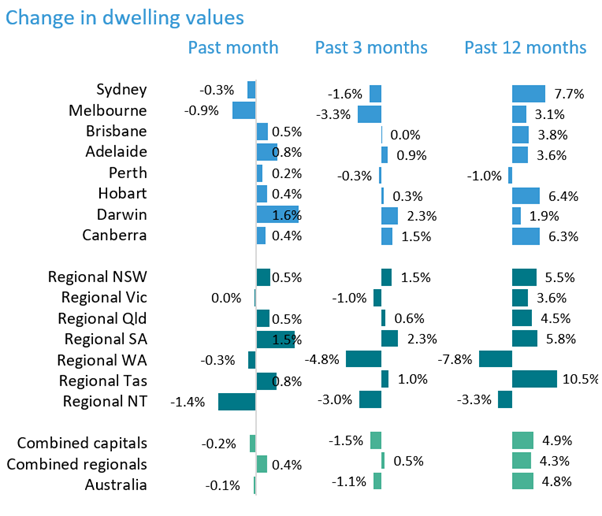

The picture becomes even clearer when you look at a breakdown of each major city’s median house price over the course of this year.

Source: CoreLogic

Over the past quarter, just three capital cities saw their median prices dip into negative territory, and those are very modest numbers considering the circumstances.

Melbourne understandably experienced a bigger contraction than anywhere else due to its second wave of COVID-19 infections and the world’s strictest lockdown measures. Sydney is dealing with economic jitters and the suspension of overseas migration, but that dip is astonishingly modest.

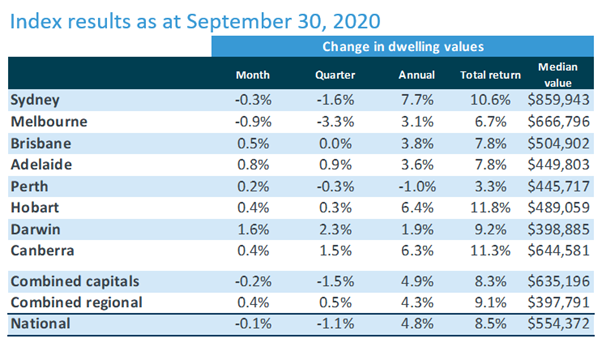

Source: CoreLogic

Why has property skated by relatively unscathed during the worst period of economic carnage in several decades?

Firstly, the major markets that fuel Australian property only recently emerged from an extended period of price correction. It was about this time last year that we began to see a renewed period of growth after almost two years of soft conditions.

In a nutshell, major markets weren’t overheated when coronavirus reared its head and so they’re better placed to weather the storm.

Secondly, demand has remained fairly strong all things considered over the past six months, in Sydney especially. At the same time, many would-be sellers are sitting on their hands if they don’t have to offload their properties. The classic supply and demand equation that drives price movement is imbalanced.

And, the economic outlook isn’t as dire as you’d expect given the difficult circumstances.

Yes, things are very tough right now. Many Australians have lost their jobs, had their hours reduced or taken pay cuts this year. And life as we know it has changed and will look and feel very different for a while longer.

But there’s an air of optimism for the mid-term. Many economists expect that the downturn will prevail into the first part of 2021 before a recovery begins.

The government is spending a massive amount of money to support job creation, as well as rushing through generous tax cuts, in order to stimulate the economy.

So, while it may be a while until we’ve fully recovered, there are economic green shoots already sprouting that will mean 2021 won’t be as horrific as first feared. The long road back to normality is a lot less rocky than thought, and we’re well on our way.

Finally, the fundamentals for long-term property market stability remain in place.

Yes, population growth has been temporarily put on hold due to a suspension of overseas migration and an immediate slump in the birth rate.

But even with those lower projections in the short and medium-term, there are nowhere near enough dwellings in Australia to satisfy demand. There’s a massive shortfall that we’re not even close to satisfying, and so future demand will outpace the available supply.

Well-located, quality homes in markets like Sydney remain sought-after and if potential buyers feel confident enough to commit, they will continue to buy them. The ingredients for a rebound in consumer sentiment are there and I believe we’ll start to see that in that during the early part of 2021.

And don’t forget, real estate is about more than investment returns. It also serves the basic human need for shelter!

But on the financial side of the things, property is a critical component of Australia’s economy and the government will not stand idly by if warning signs present themselves. They’ve already committed to generous incentives for first homebuyers as well as those constructing new dwellings. I suspect major state governments will shortly follow suit.

An important factor that will prevent a collapse in property markets is the state of Australia’s banks.

The banking sector remains strong despite the economic challenges here and abroad. The Banking Royal Commission saw an overhaul of lending practices, which was already well underway due to a crackdown by the financial regulator, and it means that we have a strict mortgage criteria and safe standards.

If you’ve tried to get a loan in the past year or so, you’ll know that very well.

The last thing a bank wants is to sell mortgagee in possession. That’s in nobody’s best interest. They would prefer to strike a new arrangement with a borrower to support them through a tough time. We’ve seen that already with the suspension of loan repayments for those needing financial assistance as a result of the pandemic.

If a borrower hits difficulty in the months ahead, they can expect their lender to be understanding and come to the table with a compromise, either by renegotiating the terms of the loan, the interest rate or switching to interest only for a period.

I don’t expect we’ll see widespread mortgage delinquency, which would otherwise have a negative effect on markets.

Australian property markets have proven time and time again that they’re resilient and adaptable, and this period of uncertainty is no different.

Through terror attacks, political crises, global financial collapse, downward pressure on growth drivers and abrupt government policy shifts, the real estate sector has shown that it has all of the fundamentals to remain buoyant in the long-term.

To have one of our friendly Buyers' Agent contact you, click here to:

call us on 1300 655 615 today.

.svg)

.svg)

.svg)