Property Price Predictions - How Accurate Are The Forecasts? - October Market Update

September 30, 2020 / Written by Rich Harvey

By Rich Harvey, CEO & Founder, propertybuyer

Written by: Rich Harvey, CEO & Founder

propertybuyer.com.au

Click here to watch Rich's Video of the October Market Update:

When I was a student studying my Master’s Degree in Economics, one of the lecturers used to joke that in the exams the questions would always stay the same but each year the answers were different. (The other joke about economists is they know the price of everything and the value of nothing!) Economics is a social science, and it has evolved over time. Many strongly held theories like the Phillips curve (that high inflation and unemployment cannot co-exist) have been disproven and adapted as fundamental economic changes have occurred and new trends and technologies have emerged.

Property economics is no different. There a variety of property price drivers that have changed over time including migration levels, interest rates, population growth, wages growth, credit controls, money supply, land supply, planning regulations, unemployment, infrastructure programs and general economic growth, to name a few.

Economic forecasts are made on the information available at the time. Australia is highly connected with the world economy yet have our own unique set of factors that drive property prices in specific locations. What happens in the world economy has an impact on market sentiment at macro level but does not necessarily determine the price of property in Manly or St Kilda, or Geelong or Parramatta at a more micro level.

The media tends to report on “the property market” in an aggregated sense, but there are over 15,000 suburbs in Australia, then even within a suburb there can be a wide variation in the performance of unit’s vs houses. The desirability (demand) of a suburb, proximity to all amenities, shops, schools and transport, and its unique features etc, compared to the availability of property types (supply) determines the ultimate price and value of real estate.

One of the primary unknown factors is how human behaviour will react to changes in economic circumstances. The Covid-19 pandemic has accelerated several trends that were already in place. The trend of working from home and telecommuting was already in place. However, it has now been demonstrated that productivity can still be maintained for many workers at home. Being able to effectively work from home has meant that aspiring homeowners have changed their location plans. No longer is it an immediate desire to be within 45 minutes commutable distance from the workplace. Buyers can now “accelerate the dream” of living in a lifestyle area and still be able to maintain their employment and business relationships, if their employer or business circumstances permit.

Covid-19 has also accelerated the trend of what I call “Feathering our Nests”. Since we are all spending more time at home, we have become less tolerant of aspects about our homes that frustrate or annoy us. The lack of a quiet study space to work at home, the second living area that means the kids can have their own play area, the bigger yard so the kids can play cricket outside, the lack of storage space, the lack of privacy from the neighbours and so on. I’m sure you can fill in the rest of the blanks on what frustrates you about your current home…

But back to the issue of forecasting. What did each of the big banks predict back in March 2020 when Covid-19 impacts first hit the headlines?

- ANZ Research expected a peak-to-trough decline of 10% on average across the capital cities.

- CBA predicted a 10% to 12% fall in capital city prices (and in worst case modelling analysis up to 32% drop – which was the figure quoted in all media headlines).

- Westpac predicted a 10% slump in national prices between April 2020 and June 2021.

- NAB predicted a 10% to 15% fall in house prices.

- AMP were predicting up to a 20% fall in prices.

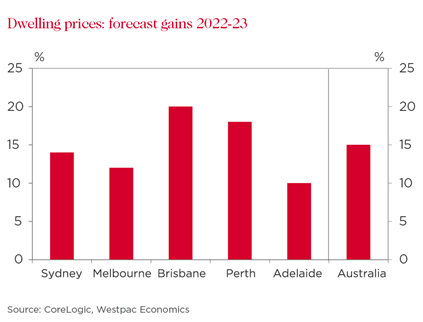

Just last week Westpac and CBA revised their property forecasts as follows:

- Bill Evans, Westpac Chief Economist, now forecasts national house prices will surge 15% until mid-2023. Westpac only expects prices to fall a further 2.3% per cent by June 2021, having already declined 2.7 per cent since the peak in April.

- CBA have now revised their forecast down to a 6% fall in house prices. In many cases we have seen this drop already.

The most recent figures from Corelogic show that property prices only dropped 2.1% in Sydney over the last quarter and 3.5% in Melbourne. In fact, during the month of August, Sydney was only down 0.5% and Melbourne down 1.2%.

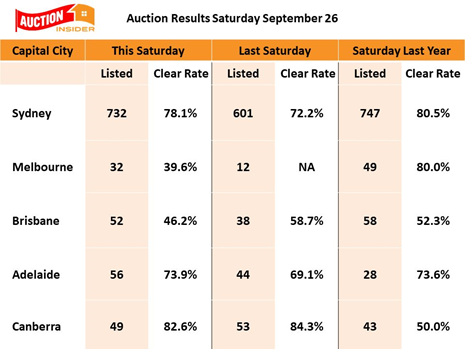

Last week the auction clearance rate for Sydney was an amazing 78% which is a very healthy figure.

Source: My Housing Market (Dr Wilson)

The key take home message out of these revised bank economist forecasts is that buyers should expect to see an even more resilient property market as we ride out the covid wave during the next 6 to 9 months till the end of June 2021, and the property cycle is likely to kick start its growth curve sooner than expected in a more buoyant market ahead in the year 2021.

My team of buyers’ agents has reported a noticeable rise in the number of buyers at open homes in the past few weeks and more spirited bidding at auctions. I don’t expect the property market to race away again, but I would recommend to buyers that are in a position to get finance and buy to do so before they face stronger competition in the year ahead.

Please get in touch with our friendly team of buyers' agents as we would love to have a conversation about your next move. Send us your wishlist or call us on 1300 655 615.

Or click below to:

and tell us what you are looking for.

.svg)

.svg)

.svg)