Upgrading - Who's moving Where and Why? - April 2019

April 5, 2019 / Written by Rich Harvey

By Rich Harvey, CEO & Founder propertybuyer

Written by: Rich Harvey, CEO & Founder

propertybuyer.com.au

I remember saying to my team late last year that 2019 will be the “year of the upgrader”. I said this because with a softening market there are far greater opportunities to get into suburbs that were previously just out of price reach. Prices have come back 13.2% in Sydney and 9.6% in Melbourne according to Core Logic. This is just the headline rate. I have seen the prices decline 15% to 20% in some areas already, so these headline figures are perhaps a little dated. And in a softer market there is typically a larger volume of listings giving buyers more choice. However, quality properties are still in demand and trading relatively quickly – so if you see the right property that suits your needs - make an offer!

ING Bank released some excellent research last week on the status of those considering an upgrade. They found that 75% of the average Aussie upgraders wanted to live in metro areas and 74% want to upgrade to a 3-bedroom house. The main reason for upgrading was the need for a nicer and larger house, while proximity to work, family and school were lower priorities.

One of the most interesting findings for me was that the biggest influence on moving was choosing a better property (62%) versus those upgrading for a better area/suburb (38%). I thought it would be the other way around, as you can always renovate or rebuild a property later in life, but you can’t move the block of dirt you’ve just bought!

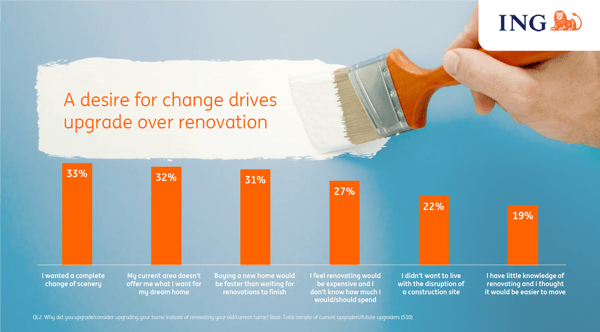

When asked “why did you consider upgrading instead of renovating” the main reasons given were:

- Wanting a complete change of scene (33%)

- The desire for more amenities in a new area (32%)

- It’s faster than completing renovations (31%)

When asked about the problems and stress involved in the upgrading process, 48% said it was difficult and 51% said it was, or will be, more stressful than finding their last home. Many said that upgrading was as stressful as starting a new job, planning a wedding, becoming a parent or buying a first home.

One the greatest challenges for anyone looking to upgrade is managing and coordinating the selling and buying process. In the survey, 65% of upgraders intend to sell their property before upgrading. More than half the respondents said they needed to find temporary accommodation between moves. The types of stop gap measures that upgraders typically choose are renting short term, moving in with friends or family or staying in a motel.

Our advice to anyone trying to line up the sale and purchase process is to SELL first and then BUY – this is the safest option. This is particularly true in a softer market when it usually takes much longer to sell. Some vendors are afraid to sell in this market, fearing they will not get a good price, but if you are trading up then you will get an even bigger discount on the property you are buying – in other words, what you may lose in the sale (by not getting a premium price) you should more than make up for that in the purchase (by getting a cheaper price).

If you’d like advice about selling your home, ask about our Vendor Advocacy service. We can refer you to the best local sales agent and provide guidance on the process.

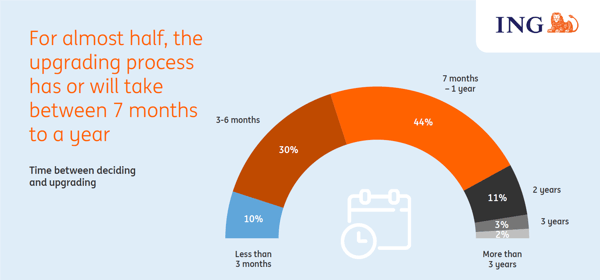

The time commitment required to upgrade your home is substantial and the research shows that most people take between 7 to 12 months. That’s a lot of Saturdays out of your weekend routine treading the path through open inspections. We track our buyer's agents performance which shows that the time elapsed between a client engaging us and buying a house is typically 35 to 55 days which is a massive time saving.

Forever home

The upgraders were asked if this next move would be their “forever home” or whether they would move a few more times.

- 53% said it would be a forever home

- 27% said it would be stepping stone

- 20% were unsure.

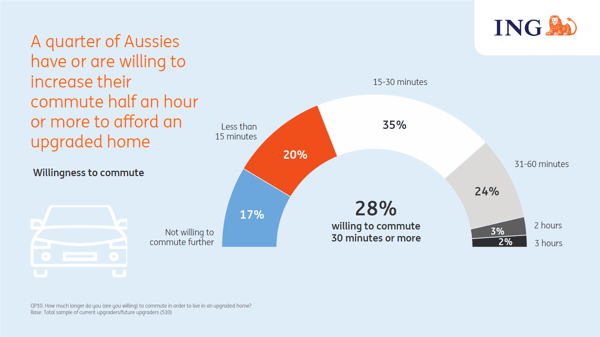

Another interesting feature of the research was that 28% of people were willing to increase their commute an additional 30 minutes or more. Intuitively, I would have thought that upgrading would mean lower travel time.

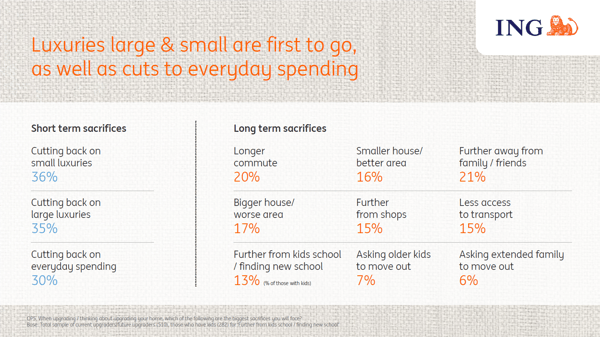

In order to fund the upgrade many people were willing to sacrifice some spending and luxuries, but they were NOT willing to forgo using ubers, date nights, beauty products or outings with friends.

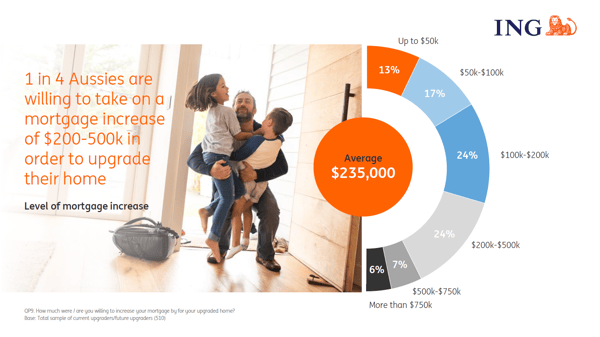

Taking on a larger mortgage is something that over 25% of respondents were willing to do. In fact, 37% of Aussies were prepared to increase their mortgage between $200k to $750k in order to achieve their dream home.

Post upgrade, homebuyers are bringing in flat-mates to help ease the financial stress of a larger mortgage. According to the research, almost a third (31%) of people that upgraded last year took on a flatmate. Of this, 32% were families.

We have had many requests from families looking to upgrade and find properties with sufficient land size to build a granny flat for additional income (or extra space for relatives or a home office). We have been highly successful finding properties both with existing flats and with plenty of space to build them.

If you are thinking about upgrading and would like to make the whole process less stressful, faster and more enjoyable, then chat to my friendly team of buyer’s agents today. They will be able to take you on the upgrading journey to find your forever home and save you a stack of money and time in the process. 2019 might be the year you can make it happen!

Click here now to:

or call us on 1300 655 615 today. We’d love to help.

.svg)

.svg)

.svg)