Understanding Australian Property Price Predictions - September 2023

September 25, 2023 / Written by Pete Wargent

By Guest Blogger, Pete Wargent,

Next Level Wealth

Following the herd…

One of the criticisms levelled at market forecasters is that they tend to suffer from herding.

That is, their forecasts tend to cluster fairly closely around a central case or range of assumptions.

After all, making a wild or outlier predictions risks the forecaster looking stupid, and could even lead to career risk!

How useful are predictions?

For this reason, predictions of what might or might not happen over the next year tend to be of limited use for investors.

A look back at the predictions for, say, 2019, for example, (or, indeed, any other year) shows just how wrong expectations can be on so many of the big issues.

The opposition didn’t win the Federal election at a canter as forecast, Aussie stocks finished the year up by a thumping 20 per cent and sliding property prices from before the election jumped by 10 per cent immediately after it.

And then consider what happened in 2020!

Initially positive forecasts were quickly replaced by predictions of Armageddon by the end of the first quarter of year (and this didn’t really play out either in the end!),

Alas the system has few effective mechanisms for clearing out bad or inaccurate forecasters, which is why it’s probably safest to take most predictions with a grain of salt.

Perversely, the internet and the rise of online media can even reward the wildest or most brazen forecasters, by generating fame.

Saxo Bank recognised this trend some years ago, and now puts out an annual list of outrageous predictions for each calendar year (not one of its ten outrageous predictions for 2019 came to pass; but, then again, that’s not their point).

Black Swan events

Of course, forecasts can be thrown completely off by unforeseen, totally unexpected, or ‘Black Swan’ events, as became all too clear as the pandemic gathered pace in 2020.

At that time, the property market forecasts around the traps were understandably gloomy.

After all, international borders were closed, starving the economy of immigration, businesses were shuttered, and periodically states endured painful lockdowns.

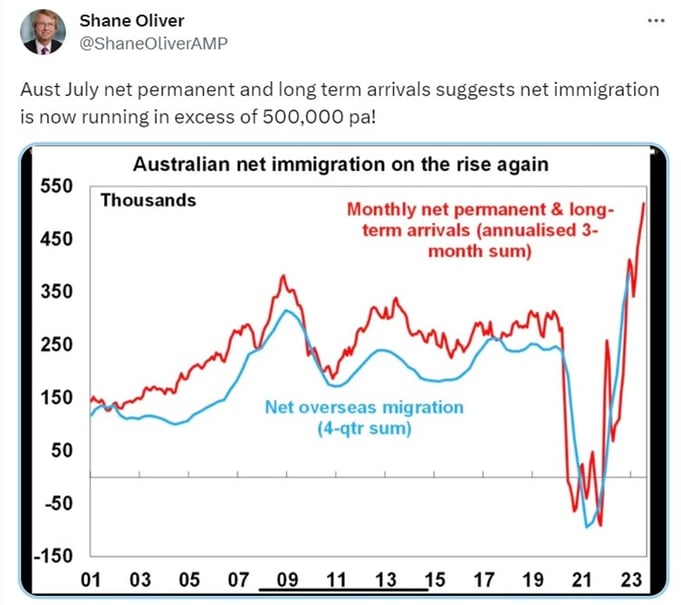

Yet, first as interest rates were cut - and now as immigration rebounded with a vengeance - property markets are once again in the ascendancy and threatening to recover new highs by the end of 2023.

Indeed, major banks have all recently updated their property price forecasts, with most economists now expected the Aussie capital city housing markets to record steady price growth in 2023, 2024, and 2025.

Current property market dynamics

Consumer sentiment is presently low as interest rates have been ratcheted higher, and housing market performance has been surprisingly overall, but patchy.

Family homes in the capital cities have often performed well this year in the face of a stock shortage, while some development sites or renovator properties have fared less well, at a time when materials and trades costs have soared higher.

Unit and townhouse prices in Brisbane have also been strong, as affordability constraints bite.

As we go into the spring selling season, more listings should come on to the market, giving buyers more choice, and dampening price growth into the end of 2023.

Still, overall the capital city markets are likely to be heading higher over the next couple of years with population growth running at record high levels of around 650,000 per annum, and new housing starts over the past quarter plunging by 23 per cent to decade lows.

Source: Shane Oliver, AMP

This will manifest a significant housing shortage over the next couple of years, until rising prices eventually help to drive a supply response.

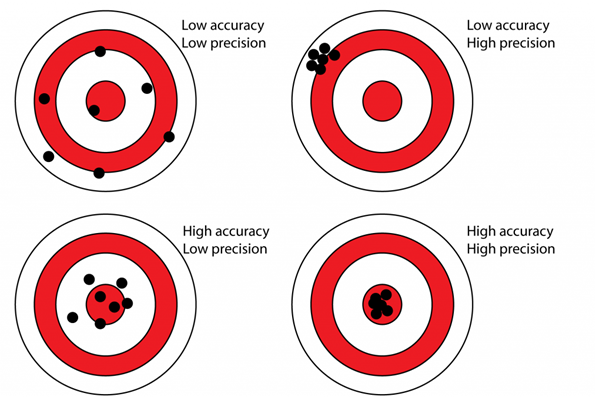

Spurious precision

One of the big accounting firms got my goat recently when it released house price growth forecasts by capital city out for 3 years…predicted to one decimal place!

Even if you could predict the future of housing markets beyond a decimal point – which you can’t – what does a percentage change at the city level even mean for individual property owners?

In short, not much!

t’s hardly their fault; this type of forecast is released all the time.

And the media runs with them verbatim because they’re precise and can produce a compelling narrative…and even if that precision is proven to be completely wrong, people will have forgotten by then anyway!

Accuracy matters

It’s simple enough to build “as if” models that make forecasts into the future, and these may be alluring because they can give precise inferences about the future.

There’s just one problem: the real world gets in the way, and the assumptions often don’t hold up in real life situations.

The future is inherently uncertain, so models and forecasts need to be questioned, because the more you know, the more you don’t know (which is an important distinction).

Rather than precise projections, the most important thing is a high level of accuracy in asking and then answering the right questions.

It’s clear, then, that getting hung up on precise metrics and values can be self-defeating and isn’t time well spent…so what is?

Tips for the future

Asking the wrong questions can be as bad as doing no research at all, so here are 3 questions that you should ask:

(i) Actions not words – will people actually do what they say they will? All too often, they don’t!;

(ii) Gut feel – what do your instincts tell you? Gut feel may be no replacement for hard information, but unconscious responses can also be a useful sense-checking tool; and

(iii) What if…? – what might happen instead if the models and forecasts are wrong?

Don’t sacrifice accuracy for illusory precision, and be prepared to update your views as new information comes to light.

To paraphrase Aristotle and Keynes, it is better to be approximately right than precisely wrong!

Property requires a medium-term view

Should buyers be sitting back waiting for everything to be ‘just right’? Or is that false thinking?

It depends where and what you are buying, but Australia is now the number one destination for global millionaires, immigration is running at record highs, and there will an unprecedented demand for housing over the next decade.

For this reason, it’s usually best to take a medium- or longer-term view.

Perth is now the most affordable capital city in Australia, and like Hobart before it, will likely now far well over the next part of the cycle, as resources investment drives a dramatic increase for housing, while vacancy rates are extremely tight.

Hobart and Darwin are the weakest markets at present, but Sydney, Melbourne, Brisbane, and Adelaide all look set to record further price growth ahead.

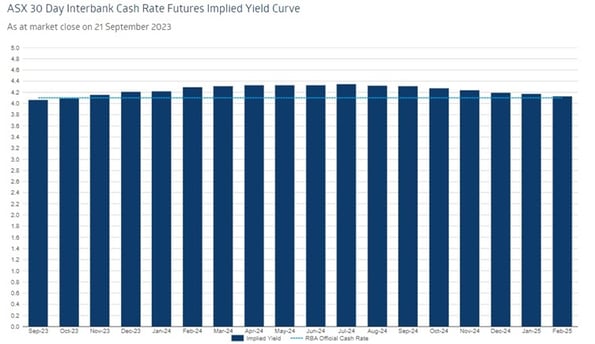

Over the years ahead, apart from strong population growth and dwelling shortages, one of the main drivers for property price growth will be the peak in the interest rate cycle, and eventually interest rate cuts and APRA reducing the lending assessment buffer from 3 percentage points (in turn increasing borrowing capacity).

The recent surge in oil prices has led markets to assume interest rates will be higher for longer, but eventually rates will need to fall as consumption in the economy slows down.

Price growth is only one of the factors for property buyers to consider, alongside personal needs, climate risk, future development approvals in the area you are buying in and more.

Think quality over quantity, look for properties with scarcity value in landlocked suburbs and try to take a long-term view.

Happy hunting!

To have one of the friendly Propertybuyer Buyers' Agents to contact

you in regards to buying property :

call on 1300 655 615 today.

.svg)

.svg)

.svg)