This Is What You Need To Know About Build To Rent - June 2023

June 15, 2023 / Written by Pete Wargent

By Guest Blogger, Pete Wargent,

Next Level Wealth

The Federal government recently reduced the withholding tax from 30 per cent to 15 per cent that is charged on distributions to developers constructing and investing in ‘build to rent’ (BTR) properties.

A serious undersupply of property in the Australian property market is something the government is trying desperately to tackle and find better solutions for.

This adjustment in the withholding tax provides a financial incentive for large institutions to construct apartment blocks at scale and make them available for the rental market.

This BTR sector is yet to become firmly established in the Australian market, but in some other countries the sector is further advanced.

For example, BTR has grown significantly the in the United Kingdom for example, to the extent that about 20 per cent of new housing is now accounted for by the sector.

In London, the figure is closer to 40 per cent.

To give you some idea of what BTR in Australia might ‘look like’ here’s a photo I took of the old ‘Wembley Way’ walk in London as I was heading down to the famous football stadium.

The borough is home to one of several major BTR hubs in London.

The sector aims to give tenants security of tenure by giving them the opportunity to sign for 3-year leases with no risk of the landlord selling the property from underneath them.

Generally the properties are not affordable housing solutions, however, with the rents typically more expensive than what is available on the private rental market.

The sector, after all, exists to generate the strongest possible investment returns.

However, if enough BTR units are supplied over time, eventually this could take some pressure off established rental markets.

The supply situation in Australia

What is the undersupply situation really like in Australia at the moment?

It’s significant, but it’s not in evidence across the board.

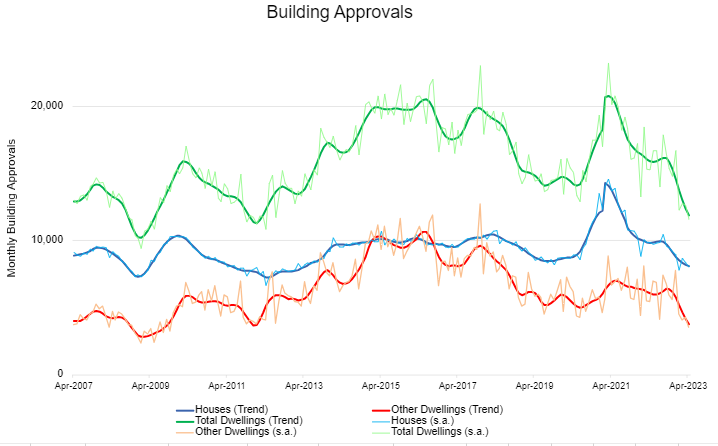

The HomeBuilder stimulus led to a record construction boom of detached housing all around the country, and due to capacity constraints and delays much of this supply remains under construction in 2023.

Meanwhile, more employees are heading back to the office in the big cities, while some ‘COVID refugees’ are returning to the capital cities.

In many regional and lifestyle markets around the country vacancies rates are therefore rising and rents are easing.

The major supply shortages are going to be most in evidence in Sydney and Melbourne, where multi-unit approvals have already fallen by two-thirds from their highs, even before the latest salvo of interest rate increases have taken effect.

While there are still many homes under construction, the pipeline is thinning out, with lending to buy or build new homes now at the lowest levels since September 2008.

Dwelling commencements have also been consistently falling for the past 18 months.

Looking ahead, in around 12 to 18 months’ time we’ll be facing some chronic shortages of rental properties in Sydney (where most new international arrivals, students, and tourists head) and Melbourne (where a fresh land tax grab has been targeted at landlords).

In some parts of the capital city markets this is already in evidence, with asking rents increasing by 20 to 40 per cent in many cases.

How BTR is different

This extremely tight rental market situation signals the advent of BTR players Down Under.

But what will BTR mean and how is this different from the usual development process that developers undertake?

The overseas experience shows that converting existing warehouses and offices into residential apartments is difficult, and therefore most BTR properties will be newly constructed and purpose-built.

Generally speaking, in Australia we can expect to see high-density apartments located close to train stations and transport hubs.

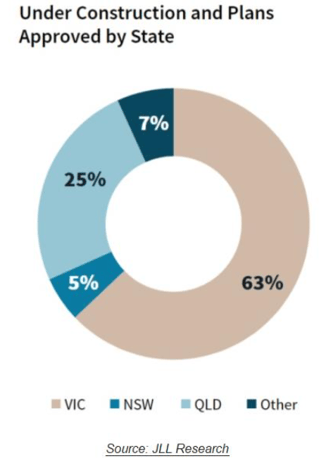

Melbourne is likely to account for up to two-thirds of BTR projects at least initially, according to JLL Research.

The Sydney market is a little less friendly for institutional players, with higher land prices and tougher constraints on supply.

But being a heavily populated state, New South Wales will account for around ¼ of BTR units, with south-east Queensland accounting for about 5 per cent.

The overseas experience shows that larger projects can be more profitable due to their scale and the largest projects to date are under construction in Melbourne’s Docklands (676 units), South Yarra (625 units), Docklands again (472 units), and Parramatta (425 units).

The withholding tax and accelerated depreciation benefits will provide some financial incentive for the big institutional investors, as well as the lure of strong and rising rental income streams.

Normally developers want to see a double-digit return on capital to compensate for the risks of developing, so we shouldn’t expect to see much in the way of affordable rentals.

Since there is a capacity constraint on construction, these are effectively units locked out of the ownership of private individuals.

The volume of the BTR pipeline

What is the projected number of apartments that likely to come into the market as a result of the incentives?

And how soon will these apartments be approved and completed?

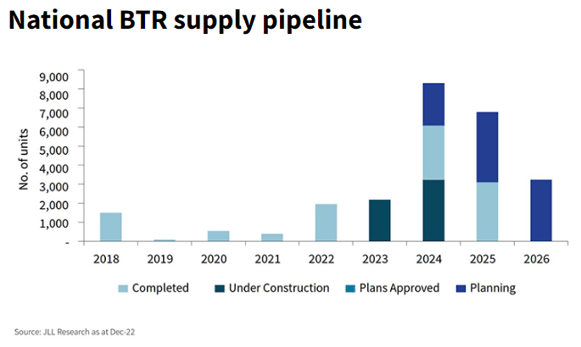

At the moment the BTR pipeline in Australia is relatively small, and since capacity constraints on materials and labour mean that it may take 3 to 5 years to deliver higher density projects, there will be comparatively little stock hitting the market soon.

There are about 20,000 units in the pipeline over the next few years, according to JLL research.

In the context of a housing market with 11 million dwellings, these may appear to be small numbers to date which won’t move the needle much.

However, there is a good deal of capital flowing into the sector, so the flow of new BTR units will undoubtedly become more significant over time.

A key question is whether these apartments be leased out at normal market rents, or will they be more expensive?

In Australia, to date the rents have been coming in around 25% higher than what is typically available on the existing market, though sometimes they may come with more modern facilities and amenities.

The UK experience in cities such as Manchester show that institutional landlords are motivated by rental income streams which match or beat inflation, so BTR rents have trended higher lately, and sometimes significantly.

The wrap: where to from here?

Build to Rent is not yet a significant part of the Australian residential landscape, but in 5 years’ time it might become so.

Should it change the way investors approach residential property?

Well, not too much.

In previous cycles much of the stock built for investors was aimed at foreign buyers, especially from mainly China.

These were small 1- and 2-bedroom units built specifically to be rented out.

Foreign buyers have been largely taxed out of the market with stamp duty surcharges, however, and this is the void which BTR will step in to fill.

Since there is typically a limit to how many apartments the market can deliver, the BTR sector will lock a chunk out supply of the private landlord rental market, and paradoxically may therefore drive apartment prices higher, even if in time it does supply more rental units.

To have one of the friendly Propertybuyer Buyers' Agents to contact

you in regards to buying property :

call on 1300 655 615 today.

.svg)

.svg)

.svg)