Mortgage Delinquency Rates - January 2023

January 3, 2023 / Written by Rich Harvey

By Guest Blogger, Pete Wargent,

Next Level Wealth

The media loves to run articles on mortgage stress and rental stress, often based upon arbitrary measures of what constitutes ‘stress.’

What is financial stress?

Is it when you spend more than 30 per cent of your disposable income on a mortgage on your rent?

I did this a lot when I was younger but was never in serious or realistic danger of defaulting on anything!

Is it when cashflows over a year are negative as you run down savings?

I have done this many times over the past 25 years or so, and never considered it as a key measure of stress, if there is a savings buffer in place.

The aggregate data shows most households have savings and mortgage buffers built up over recent years.

How to measure mortgage stress

Fortunately, we have a de facto measure of stress when it comes to the housing market, which is 30+ day mortgage arrears.

This serves as an early warning mechanism for problems down the track.

At the moment we have the lowest unemployment rate since 1974, record low rental vacancy rates, and rents rising at around 20 per cent per annum.

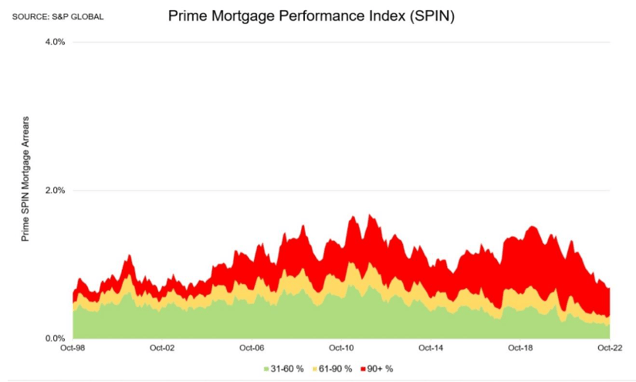

In that context, it is not surprising that prime mortgage arrears are running at around all-time lows at around 0.7 per cent on the last measure.

Of course, we expect mortgage arrears to rise next year, as interest rates have been increased sharply to cool a red-hot economy.

Indeed, we might just be starting to see the first signs of late repayments in late 2022.

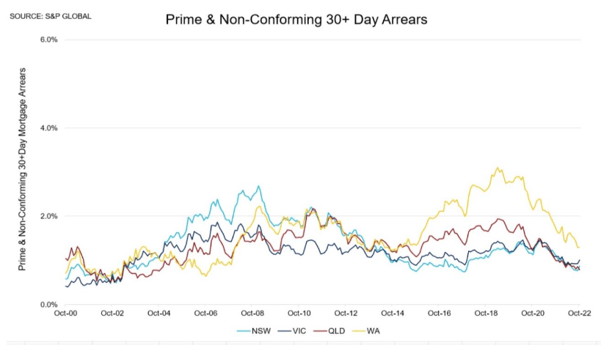

In New South Wales and Victoria, where the average mortgage balances are highest, we have just seen the earliest increases in mortgage arrears, albeit tiny increases to historically extremely low levels.

You can see from the below chart that the global financial crisis saw 30-day mortgage arrears in New South Wales rising to around 2½ per cent, while the end of the mining boom and a recession in Western Australia saw mortgage arrears topping 3 per cent out west in 2019, though there has been a sharp improvement since.

Queensland has occasionally had elevated mortgage arrears driven by flooding, though not lately as lessons have been learned in this regard, in terms of appropriate planning and insurance.

There are a few pockets of stress now, including in the Northern Territory, and in some of the east coast cities where flooding has had a major impact in 2022.

Responsible lending changes

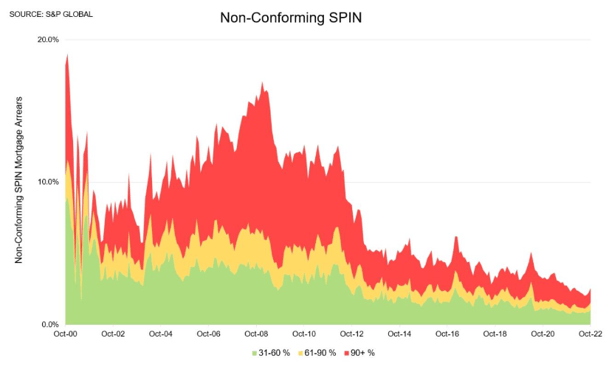

One of the key differences between now and before the global financial crisis relates to the tightening up of responsible lending rules.

Where 100 per cent mortgages and low-doc loans were once commonplace, these are no longer a key feature of Australia’s mortgage landscape.

Non-conforming loan arrears topped an alarming 23 per cent in the early 2000s downturn, but today represent a tiny proportion of at-risk loans in Australia.

Expectations were also reset through the pandemic, with lenders very keen to avoid problem loans leading to forced sales, and the widespread introduction of mortgage holidays for stressed borrowers.

Regulators have taken a far more pro-active approach to systemic risks since the financial crisis, as we have seen through the banking and financial services Royal Commission, for example, or the huge crackdown on interest-only lending.

Rising mortgage rates

The full impact of interest rate increases could take a year or more to be felt in full in the housing market.

Mortgage arrears will rise in 2023 as interest rates rise and the economy slows.

But remember to put the figures in context.

Mortgage arrears have never been as low as they are today, and lending standards are far more robust than 15 or 20 years ago.

Mortgage arrears were running at double these levels in 2009, but there were few significant implications overall.

It is more likely that increasing mortgage repayments is reflected in a sharp slowdown in consumption for household goods and recreation.

The time period when borrowers come off fixed rate loans could provide a very good opportunity for savvy buyers to look for competitively priced property from more motivated vendors the have a greater need to sell.

While they may an increase in mortgage delinquencies, do not expect to see widespread forced selling. We are fortunate in Australia to have a stable and robust lending environment.

To have one of the friendly Propertybuyer Buyers' Agents to contact

you in regards to buying property :

call on 1300 655 615 today.

.svg)

.svg)

.svg)