Mid-Year Market Update - Property Prices Resilient or Heading Over the Cliff? - June Market Update

June 3, 2020 / Written by Rich Harvey

By Rich Harvey, CEO & Founder propertybuyer

Written by: Rich Harvey, CEO & Founder

propertybuyer.com.au

Click here to watch Rich's Video of the Mid-Year Market Update:

I was interviewed on 7 News last week about the forecast by CBA that property prices could drop 32%. The media headlines tend to exaggerate and emphasise the worst-case scenario rather than most likely scenario. What they failed to explain was that this type of fall could only happen if we had 2 FULL years of recession (ie 8 quarters of negative economic growth). The more likely scenario (base case) is that prices may fall approximately 11% as we move to recovery phase after two quarters of recession.

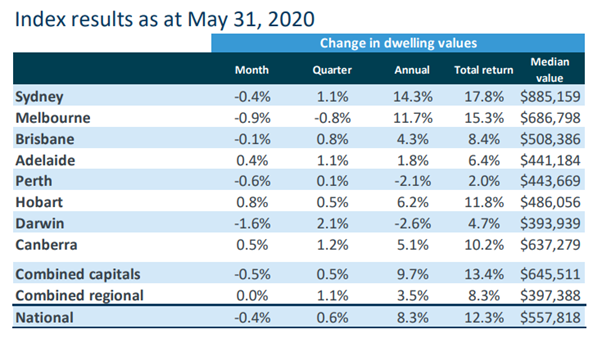

The actual results so far are that national property prices have dipped just 0.4% over the past month according to the CoreLogic Home Value Index results for May (see table below).

The volume of listings did fall off a cliff during April with volumes down 30% to 50% in some areas and agents scrambling to get new listings. However, sales activity has bounced back 18.5% in May. The severe shortage of listings has also helped to underpin prices in many high demand suburbs.

I was due to inspect several properties last Saturday but found that two had sold the night before auction. Auction clearance rates have started to resume some level of normality as we come out of lockdown and last weekend saw the Sydney auction clearance rate at 62% from 367 listed auctions.

CoreLogic head of research, Tim Lawless, said “Considering the weak economic conditions associated with the pandemic, a fall of less than half a percent in housing values over the month shows the market has remained resilient to a material correction. With restrictive policies being progressively lifted or relaxed, the downwards trajectory of housing values could be milder than first expected.”

We’ve noticed a positive change in property market sentiment as we come out of covid-19 lock down and move into the winter season. The level of visitors to our website has increased around 20% and we had more enquiries from home buyers looking to upsize or downsize depending on their stage of life and investors seeking to take advantage of a softer market.

This observation corresponds with the rapidly rising consumer sentiment which has a strong correlation with housing market activity

“Measures of consumer sentiment have shown attitudes to be consistently improving since early April, after dropping sharply as the virus curve worsened and severe social distancing policies and border closures were implemented” according to Mr Lawless.

The weekly ANZ Roy Morgan index has risen consecutively for the past 8 weeks, with the index 42% higher than when it bottomed out in late March. The Westpac MI consumer sentiment index also rebounded 16.4% from April to May, recovering around three quarters of the April drop. While consumer sentiment is still at relatively low levels, real estate transaction volumes are likely to benefit from this partial improvement.

“With consumers feeling more confident, households are better equipped to make high commitment decisions such as buying or selling a home. A lift in housing market activity should also support broader economic activity, with housing turnover providing positive flow-on effects to other sectors including retail, construction and banking,” Mr Lawless said.

A recent May survey completed by the Property Investment Professionals of Australia (PIPA) discovered that 72 per cent of investors believe now is a good time to invest in residential property.

PIPA chairman Mr Peter Koulizos, claimed the survey has revealed an “overwhelmingly optimistic” sentiment held by Australian property investors which interviewed 1,850 investors.

The key findings of the survey were that:

- 80% of investors have not changed their investment intentions over the next six to 12 months, despite the economic impacts of COVID-19.

- Approx 30% of investors were more likely to buy a property in the next six to 12 months because of the pandemic.

- Just 5% of respondents indicated they would be more likely to sell a property over the next six to 12 months.

- Most investors indicated they had the financial buffers to see them through the current economic uncertainty. Only 8% had applied for mortgage holidays.

- 20 per cent of tenants have been approaching their landlords with requests for rental relief.

Overall, the survey shows that investors are fairly confident about the future and understand that the covid crisis is a short-term impact that will not derail their long-term investment plans but instead provide an opportunity to get into the market.

The Jobkeeper and other stimulus packages are cushioning some of the economic pain that both businesses and individuals are suffering at the moment. However, the government still has more fire power available to stimulate the economy is likely to announce more measures soon to specifically boost housing demand. It’s likely that once sentiment resumes its prior levels, we will see a pickup in property market turnover.

One of the frequent complaints we hear from current buyers is the lack of stock. Accessing those opportunities, away from the intense competition and manic market conditions, is a perfect opportunity for buyers. An experienced and well-connected buyers' agent can connect you with these prospects, unlocking untold potential. They can draw on their extensive networks and connections to locate off-market options that you’d otherwise never know about.

Therefore, if you can increase the supply of properties and provide yourself with more opportunities, and at the same time decrease your buying competition and capitalise on a market where many agents are willing to do deal, you may well find yourself well ahead of the herd.

If you would like to chat to my friendly team of buyers' agents about your property strategy in the year ahead please give us a call on 1300 655 615 or email us today to start a conversation. We’d love to help you on your property journey.

Or click below to:

and tell us what you are looking for.

.svg)

.svg)

.svg)