Mid-Winter House Price Forecasts – July Market Update

July 2, 2023 / Written by Rich Harvey

By Rich Harvey, CEO & Founder, propertybuyer

Written by: Rich Harvey, CEO & Founder

propertybuyer.com.au

Click here to watch Rich's Video

With the financial year just passed many people are looking at their finances and taking stock of what to do next. There's a confluence of factors continuing to underpin the property market and some challenging conditions for buyers. In this market update we review Domain’s latest price forecasts which has some surprising results.

Interest rates bite

As the winter chill really starts to bite, so too will higher interest rates for those borrowers who are coming off very cheap fixed rates of circa 2% onto a variable rate of around 6%. The rapid-fire interest rate rises have taken a much longer time than usual to curtail consumer spending and rising inflation.

During the winter months, the property market traditionally goes into a subdued state of hibernation. However, this year it is likely to see continued strong activity simply because of a severe lack of listings available on the market - sales volumes are down around 30% compared to their longer-term average.

The lack of available properties for sale is contributing to significant competition in the buyer pool and helping to push prices higher once again. We're likely to see a higher number of properties coming onto the market as we head into late July and August.

While some commentators are suggesting that we are likely to see a significant rise in distressed sales, I don't believe there will be blood on the streets or any significant level of panic selling. There may be some more motivated sellers out there deciding to sell their properties due to their inability to service the loan comfortably, while the majority of property owners are likely to ride out this difficult period of higher rates.

Dominant market forces

One of the primary driving forces of buyer demand in most capital cities is the massive influx of migrants from overseas. With around 400,000 migrants expected to arrive on our shores in this calendar year, this is putting significant pressure on our housing markets. As a result of this post-Covid migration boom we are seeing national vacancy rates around 1% (historically low) and a significant shortage of rental properties, leading to continual rental increases.

With all the talk of technical recession, interest rates going higher and global instability, the average buyer is nervous about taking the plunge into the property market. History has always shown that real estate is one of the best hedges against inflation, and one of the most stable wealth creating assets. We often have a shortsighted view when we make decisions about whether to buy or sell property - but to be wise about property decisions you need to take a long-term view about what provides the greatest security and consider how to future-proof your financial needs.

To summarise, the sheer volume of natural population increase and migration, combined with ongoing demographic trends around housing shortages, will continue to be a major driving force for the property market.

Another critical factor that will drive property prices higher, is the significantly lower volume of building approvals likely to materialise over the next two years. With construction costs having shot up 40% to 50% during the Covid period, many development projects have become less viable, so they are simply shelved. At Propertybuyer, we are regularly hearing that people who were intending to do a knock down rebuild or a large house renovation project, are now rethinking their plans completely. They got a rude shock when they received their building quotes and some have decided to simply sell and find something that is already renovated or brand new. Not having to go through the painful building process of getting council approvals with its continual long delays, and building escalation costs is starting to look more appealing.

Coupled with unstable construction costs is the availability and cost of new land to build on. Land prices will continue to rise as planning requirements in each State become more complex, plus developer charges for local infrastructure are hefty and there is a limited amount of suitable land available.

Building approvals across Australia are typically around 160,000 per annum. But around 30% of these approvals are either not completed, delayed or simply shelved. So that means only around 112,000 dwellings are actually being completed every year which is at odds with the required underlying demand for property at around 180,000 dwellings pa. Considering this simple mathematics, it shows that we are around 68,000 dwellings short per annum and this is likely to compound over the next three years as 400K migrants arrive on our shores.

So, if you are sitting on the sidelines thinking that just because interest rates are high that property prices will come down, then you need to seriously think again. If you can service a loan and want to secure your wealth, buy the best property you can and watch it grow.

Curtailed borrowing capacity (which is down circa 30% since last year) will be a key factor in limiting the extent of house price rises in the coming year, but intergenerational wealth (aka the bank of Mum and Dad) will also play a role in helping address the rising issue of affordable housing. Adding to this Australia’s superannuation policies from the last three decades have ensured that families are very well positioned for the long term.

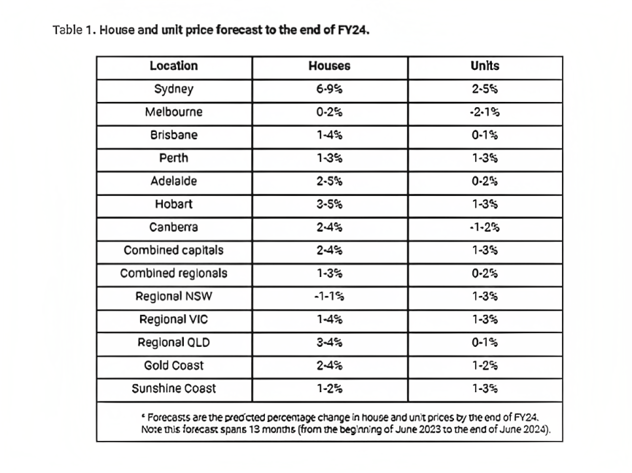

A recent report by Dr Nicola Powell, Chief of Research & Economics for Domain, has undertaken price modelling and predicts that five capital cities on set to new record prices over the next 12 months. See outline below:

|

Source: Domain House Price Forecast June 2023

Sydney is set to see a serious turnaround from its post-Covid correction and lead the charge with house prices rising between 6% to 9% and units rising 2% to 5%.

The Melbourne property market is expected to stablise and show small gains with house prices rising circa 2% and units declining up to 2% or rising circa 1%.

The sunshine state is expected to perform strongly with Brisbane house prices expected to achieve a new record price by end of June 2024 – and house prices rising up to 4% and units just 1%.

In South Australia, Adelaide will continue to perform strongly with house prices set to rise 2% to 5% and units 1% to 3%.

On the East coast, Perth is showing very promising signs of recovery with house price and unit prices set to rise up to 3%.

These broad forecasts above mask the local variations that we regularly find for our clients in the highest performing suburbs. We use our own proprietary algorithms using suburb selectorTM to help our clients choose the ideal region and suburbs that will deliver the highest predicted capital growth and cashflow for their budget.

.svg)

.svg)

.svg)