April 2016 - Making Lazy Equity Work For You

April 4, 2016 / Written by Thirst Creative

By Rich Harvey, Managing Director propertybuyer

Using your equity wisely is a key stepping stone to wealth creation and good money management. Do you know how much equity you have in your home or property portfolio right now? Would you like to get your lazy equity working for you and what is the cost of doing nothing? See below for the answers. Be sure to book in for our next seminar in early May where we look at the tax implications from this year’s budget.

This April update includes:

1. Main Article - How to Make Your Lazy Equity Work For You

2. Seminar - 'Smart Tax Strategies for Property Investors'

1. How To Make YourLazy Equity Work For You

If you have owned a property for longer than 3 years there is a very strong possibility you are sitting pretty with some equity growth. Equity is a very powerful ingredient to help create wealth and put you in a position to retire financially secure. Equity is a simple concept – it’s the difference between what you own and what you owe.

For example if your home is worth $1.2 million and you have a mortgage of $500,000 then you have equity of $700,000.

But one of the biggest mistakes that property investors make is sitting on “lazy equity” – i.e. doing nothing with the equity that their property portfolio has created. The opportunity cost of doing nothing can be easily quantified. Being an economist in my past life I think this way all the time –constantly doing cost-benefit analysis in my head about property opportunities.

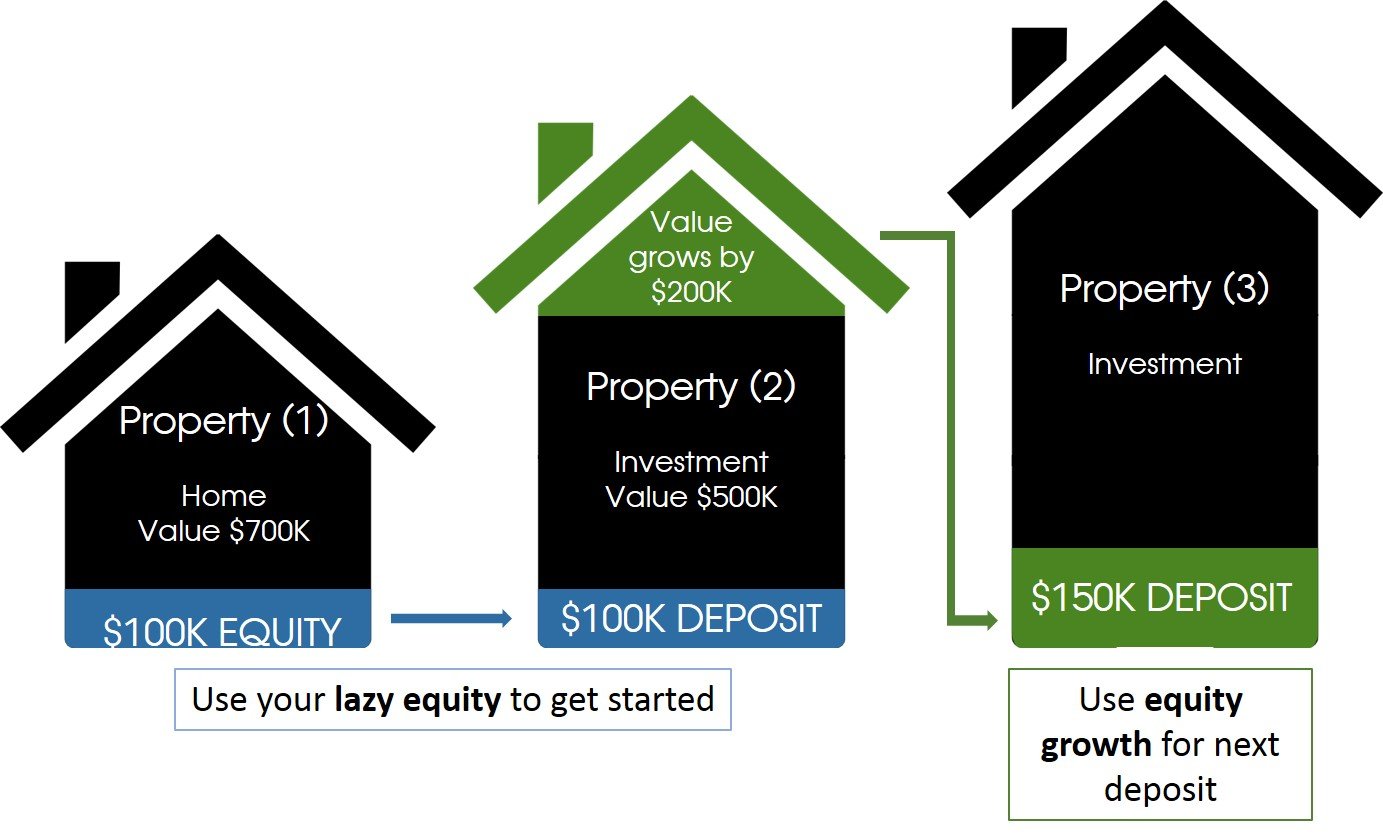

Let’s take an example. Say you have $100k sitting in an offset account or as equity in your home, then (depending on your income) you could qualify to purchase a property around $500,000. Taking a very conservative 5% pa growth assumption this produces $25,000 p.a. additional equity (or around $480 per week). Now looking ahead say 10 years in the future, the opportunity cost is $314,000 in lost equity and then in 15 years, by which time the property could have doubled in value, the opportunity cost is a massive $539,000. And this is just for one property….imagine what equity you could create if you set a goal and acquired multiple properties.

If you had been a smart investor and chosen a suburb that has a higher growth rate, then you could achieve much higher levels of equity and fast track your progression up the property ladder. Savvy investors look to recycle their equity as quickly as possible. Once you have some growth, talk to your broker and get a bank valuation arranged. This way you get your money working for you rather than you working for money. It’s about time the tables were turned and I recommend you review the performance of your portfolio at least yearly.

Talking of smart - Albert Einstein has said “Compounding is the eighth wonder of the world. He who understands it, earns it… he who doesn’t… pays it”. The earlier in life you understand and embrace the principle of compounding, the better off you will be.

Below is a simple graphical presentation of what I mean by recycling your equity. It’s a bit like the rinse and repeat cycle on your washing machine. By duplicating this process you are well on your way to building a larger portfolio.

Below is the progression of Sydney’s median house price over the last 4 decades to give you some motivation to get on the property ladder:

1980 – $68,800

1990 – $194,000

2000 – $287,000

2009 – $547,000

2016 - $1,050,000

Some of you might have heard that you should never use your home equity or wait till the mortgage is paid off. I disagree wholeheartedly. While you should be paying off your non-deductible debt (on your home) you should ALSO be investing in property with the equity you have. It is very difficult to “Save” your way to wealth. How long does it take to save $100k vs creating $100k in property equity? With the right advice and structure you can do both.

If you have any fears about using home equity for investing I recommend you speak to a mortgage broker that can arrange the right finance structure for your individual situation. Using “lazy equity” means you don’t have to save up for the next deposit – you have already have it!

Now don’t rush out and buy the first property you see or get sucked in by a property spruiker – get a team of professional advisors around you including a buyers’ advocate and a finance broker to help you navigate the best path to financial freedom. It’s not rocket science – it is just a matter of making a priority in your life.

Rich’s quick tips:

1. Revalue your property

2. Recycle your equity quickly and cautiously

3. Talk to a mortgage broker – ask us for a referral to a savvy mortgage broker

4. Put that equity to work again in another property- use our team of buyers’ agent to help you find an investment grade property

If you are looking for a leg up with your property search we would love to assist you. Please call my friendly team of professional buyers' agents on 1300 655 615 or complete your wishlist today.

If you are looking for a leg up with your property search we would love to assist you. Please call my friendly team of professional buyers' agents on 1300 655 615 or email your wishlist to discuss your requirements today. We'd love to help.

Rich Harvey is founder and Managing Director of www.propertybuyer.com.au, Australia's most awarded Buyers' Advocates. Propertybuyer helps property investors and home buyers search and negotiate the right property at the right price, every time. Visit www.propertybuyer.com.au or call 1300 655 615.

2. Seminar - Smart Tax Strategies for Property Investors

Wednesday, 4th May 7-9pm

SMC Centre, Sydney

The media is rife with stories of threats to negative gearing and changes to superannuation; stricter lending requirements, looming Federal Budget Policy announcements and the new direction of our local and interstate real estate markets – all of which is creating an environment of uncertainty and inaction for property investors.

How can you manage your risks and generate return on your investments in this changing environment?

Topics Covered:

- How to structure your properties and assets in the correct structures to legally reduce taxes and beef up asset protection

- How to protect assets in your personal name without Triggering Taxes such as Capital Gains Tax and Stamp Duty

- Estate Planning: How to protect assets in your family bloodline (away from the in-laws)

- How SMSF’s work and the benefits for property investors

- Where we are at in the current property cycle?

- The prospects for Sydney, Brisbane and Melbourne’s How to select “Investment Grade Property”: What kinds of investment properties you should really be focusing on, for Capital Growth and High Rental Yields

- Property Investment Ideas and Strategies

- How to finance your property purchase now government has set tougher investor lending criteria

- What are the New Lending standards exactly?

- What the Banks are doing and reacting to market conditions?

- How and where can investors secure finance?

Date: Wednesday 4 May 2016

Time: (6.30pm registration), 7.00pm start to 9.00 pm

Venue: SMC Centre, 66 Goulburn St, Sydney (Doric Room)

Cost: $19 single, $29 double ticket

Telephone enquiries: 02 9975 3311

.svg)

.svg)

.svg)