Managing Buying Emotions - February Market Update

February 4, 2020 / Written by Rich Harvey

By Rich Harvey, CEO & Founder propertybuyer

Written by: Rich Harvey, CEO & Founder

propertybuyer.com.au

Click here to watch Rich's - Managing Buying Emotions (Video):

Over the last 20 years as a Buyers’ Agent, and being involved with over 3000 transactions, I have seen an incredibly wide range of buying emotions. I’ve have found that there are three distinct types of buyers:

- Active Buyers – these buyers have a positive self image, take the initiative and seek out best deals by researching extensively. They are regularly looking at their financial position and willing to calculate the returns and mitigate the risks. They have a plan and end goal with their property investing and home buying. They expect the property to perform well and review the rents at least yearly. They are usually time poor leveraging the search function out to a buyers’ agent. As soon as they have some equity or additional cash they are looking to expand their portfolio.

- Reactive Buyers – these buyers take action only when prompted and realise often too late that to achieve their financial goals they should have started 10 years ago. They are waiting for that “perfect” time when the market is down to buy. Reactive buyers often suffer from “paralysis of analysis” and try to gather up so much information that they end up getting confused. The reactive buyers need reliable information to make decisions but take a long time to get their act together. They might respond to a special offer and think that just buying one or two investment properties will get them to financial freedom rather than embarking on a specific plan.

- Passive Buyers – these buyers sit on sidelines and watch others make money, thinking they should do something but lack the motivation to get going. They are less trusting of others and need proof that property investing actually works. They fear failure and therefore procrastinate rather than taking action. They are wary of real estate agents and believe the world is full of sharks ready to devour them. They are very frugal with money but still want to achieve financial security.

Which one best describes you?

What are your personal property goals for 2020 and beyond? Are you seeking to upgrade and find your dream home? Do you want to create a portfolio of 5 properties that pays you $120,000 pa and provides financial freedom? Perhaps you haven’t set a goal yet or perhaps it’s something you’ll get around to later because it seems like too much hard work to research the right kind of properties.

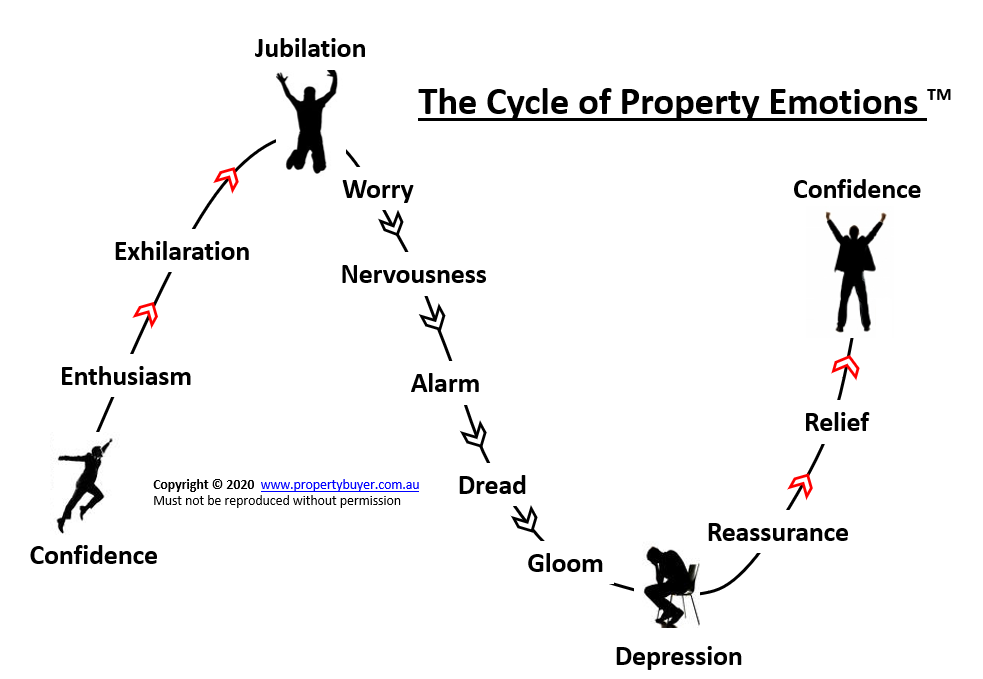

The reality is that to achieve any worthwhile goal you must create and be committed to a plan. In buying a home or investment property, you are likely to encounter a whole range of emotional highs and lows. I have developed a theory called the “Cycle of Property Emotions™”.

When starting out, I see buyers full of optimism and confidence and with high expectations of finding the perfect home or deal of the decade. The buyer approaches the search with enthusiasm believing that the search will show up hundreds of excellent properties. One is found, bought and the champagne is popped for the celebrations (jubilation!).

However, buyer’s remorse and worry soon kicks in when the buyer discovers a few hairline cracks in the wall (or the tenant missed a week’s rent). You start to get nervous and have a few restless nights wishing you had done more due diligence before signing the contract. You become alarmed when reading negative media articles that suggests there is a property bubble and prices are 40% over valued or Trump is about to blow up a trade deal. This gives way to dread and panic starts to set in as you think “perhaps I really have made a terrible mistake and should have stuck my money in the bank.” Depression overcomes you when you consider how long it took to save up the deposit. Shadows of gloom appear when you remember you have to explain yourself to your accountant in July. But then the market begins to turn, some positive stories come out, interest rates drop a little and the future is looking bright again. This gives way to relief that you didn’t sell the property prematurely and holding for the long term was OK and provides the confidence to buy once again.

Whatever stage of the buying cycle you are at, be aware of the range of emotions that you are likely to experience. Consider your overall strategy and don’t be reactive to something that can be managed, like a bad tenant. Also consider the reality of the market – increasing population growth and changing demographics mean demand for property will increase in most areas. But be very selective where you buy!

It’s important to manage your emotions during the buying cycle. Many of our clients have commented that they found having a buyers’ agent on their side helped them smooth out the rollercoaster of emotions and stopped them making expensive mistakes.

We would love to help you find your next home or create a plan to help you build a portfolio of high growth and positive cashflow properties that makes your wealth creation goals a reality.

It makes good sense to have a professional expert by your side helping you navigate the changing waters of the Australian real estate market. If you would like to develop a property strategy and build a property portfolio without remorse, then please call us today on 1300 655 615 for a friendly chat with my team or click here to send an email inquiry.

or click below to:

.svg)

.svg)

.svg)