Late Spring Surge - October Market Update

October 7, 2021 / Written by Rich Harvey

By Rich Harvey, CEO & Founder, propertybuyer

Written by: Rich Harvey, CEO & Founder

propertybuyer.com.au

Click here to watch Rich's Video of the October Market Update:

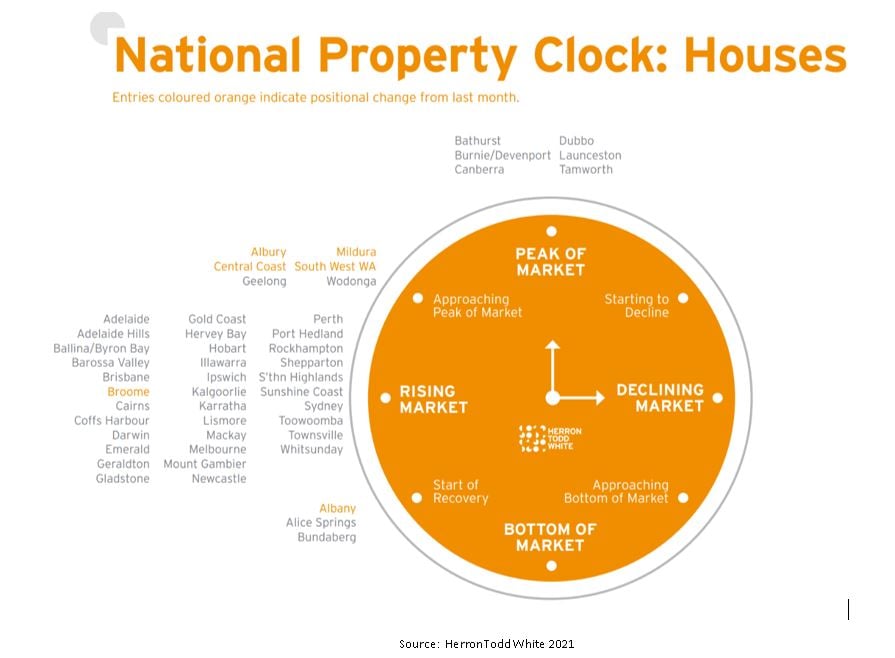

I don’t recall a time in my 20-year career as a buyers’ agent when virtually ALL of the cities AND regional areas are in the 9-12 o’clock segment (ie rising to peaking) – see chart below.

There is no doubt we are in the middle of an extended property boom. Once lockdown is over in Melbourne and Sydney, I expect to see a much higher level of transactions in the property market.

Lockdown hangover

Extended lockdowns in both Sydney and Melbourne have severely constricted the volume of listings that normally flood the market in the spring selling season. But with the easing of restrictions should come the renewed confidence of vendors to list their property for sale before Christmas, leading to a late surge in activity in November and December.

If you are out there trying to buy a property at the moment – I know how you feel…. frustrated, exhausted, annoyed and over it (much like lockdown really). Well don’t despair…the volume of listings is starting to rise – just not as fast as the buyers would like. As economic confidence returns across the country, we should start to see some re-balancing of the property market.

The very bullish buyers that are putting in super high offers to snare the limited listings will be out of the way soon, paving the way for more moderate buyers to have a chance. But these bullish buyers have also created new price precedents that new vendors will be hoping to achieve. The only way to see a true re-balancing in the market will be when more supply comes online. But don’t expect prices to drop – in fact they will continue to rise – just at a more moderate pace.

With listings volumes down 29% over the past 5 year average, and demand up 30%, it’s simple economics that prices have shot up.

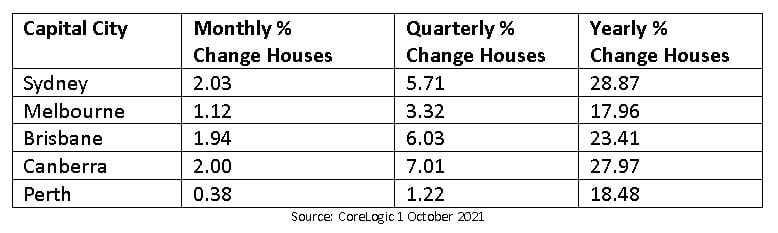

The latest price moments from Corelogic are shown below:

This chart doesn’t mean you can buy anywhere and expect to do well. Careful research is still required to identify the long-term drivers of capital growth if you are savvy property investor or home buyer. The property clock is a simple representation of the general trend which masks many variations at the micro suburb level.

Lending Restrictions

The other dark cloud on the horizon is the imminent macro-prudential lending restrictions that APRA (the financial regulator) is likely to apply in the next two months. The RBA and APRA cannot control property prices, but they control the amount and price of credit available in the market. The main issue is the “debt to income” ratio – they don’t want borrowers over-extending themselves.

At the moment there are still more home buyers in the market than investors- so I think the measures they introduce will be light to moderate – not heavy handed like they did in 2016/2017 which really slowed the market. I trust that APRA will be sensible in just touching the brakes rather than pulling the hand brake hard.

The Tide Returning

One of the many trends that Covid accelerated was working from home. However, many of us are tired of the solitary work life and crave the social interaction / collaboration that comes from working in close proximity to other colleagues.

Employers are likely to recall their staff back to the office at least 2 to 3 days a week from early next year. While many buyers embraced the sea change or tree change, I believe the tide is now turning back to the cities as we come out of lockdown. The more traditional locations and suburbs closer to the CBD will once again resume their dominance in terms of value. But the regional and coastal areas will ALSO continue to thrive as employees travel between the two.

One of the things I have loved about lockdown is the light traffic. I can skip across town in half the usual time to do my inspections. But as Freedom Day approaches, I am anticipating a lot of traffic congestion's and chaos on the roads as we all escape our LGA’s in search of a short break away.

Please reach out if you need help with your property buying plans – send us your wishlist or give us a call on 1300 655 615. And drop me a line if you have topic you’d like me to cover in future months.

Click here to:

or call 1300 655 615

.svg)

.svg)

.svg)