Is Now a Good Time to Buy? - March Market Update

March 6, 2024 / Written by Rich Harvey

By Rich Harvey, CEO & Founder, propertybuyer

Written by: Rich Harvey, CEO & Founder

propertybuyer.com.au

With the property market constantly changing, many people are wondering: "Is now a good time to buy? This month, I'll be taking a look at current market conditions and looking forward over the next 6 to 12 months to provide insights for those considering buying a property.

Is Now a Good Time to Buy?

The astute answer to the question “is now a good time to buy?” depends on your personal situation and your goals and life stage. And it also greatly depends on your borrowing capacity and financial situation. As a buyer's agent with over 24 years of experience, I'm here to help you navigate the current market and understand the economic conditions that might influence your buying decisions. I have observed many potential buyers scared of debt, or worried about market conditions, and then delay their property buying plans until they “feel" it is the right time to buy.

In the meantime, the market may have rapidly accelerated, and prices moved up 10% or 15% over a 12 month. And again, they find themselves potentially priced out of a market they could have got into, had they made an educated decision.

Trying to time a perfect entry into the property market is extremely difficult. However, there are some obvious clues and market signals that I look for, that indicate a more favourable time to get into the market rather than waiting on the sidelines. Before I reveal the six key reasons that I believe now is a good time to buy, I’ll outline the current state of the market in key capital cities and the mood of the buyers and vendors.

Consumer Sentiment - has remained very low for the past two years as we have seen a property market correction brought on by higher interest rates and extremely rapid cost of living pressures. The consumer sentiment index as measured by the Westpac Melbourne institute is bouncing around 80 to 85 points which was at a similar level back in 2008 during the global financial crisis.

Auction Clearance Rate – This year has started out with surprisingly very strong auction clearance results. The last couple of weeks has seen the Sydney auction clearance rates around 70% to 75%, Melbourne around 68 to 70% and Adelaide around 80% - and these results are all coming off the back of much larger volumes of auctions (over 1000 in Sydney and over 1200 in Melbourne). This indicates a very healthy demand for property and still significant shortage of supply.

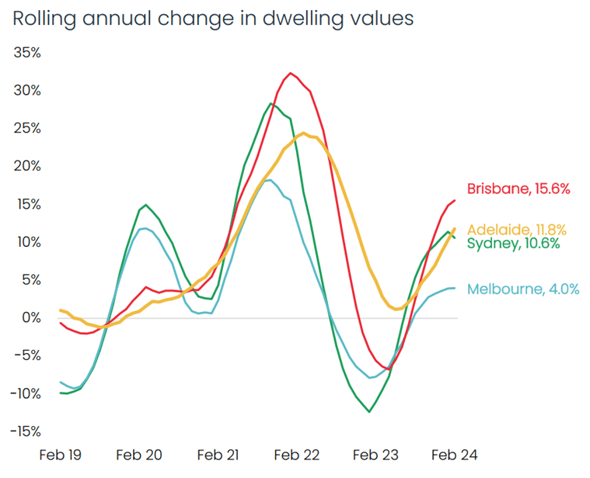

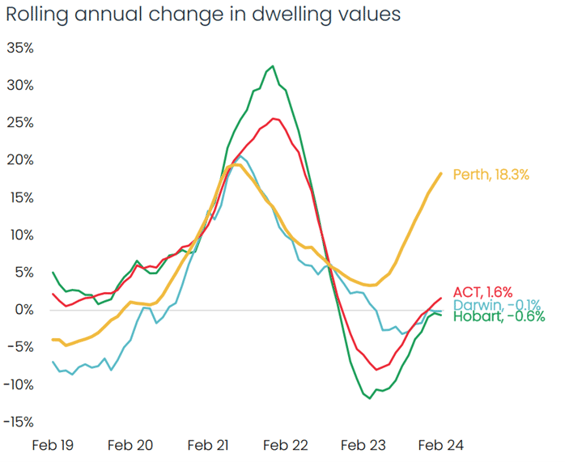

Annual change in dwelling values changes over past 12 months.

The trend in housing values has diversified through the second half of 2023 and into 2024. Multi-tiered conditions have emerged with Perth, Adelaide and Brisbane leading the pace of gains while values across Hobart and Melbourne have trended lower.

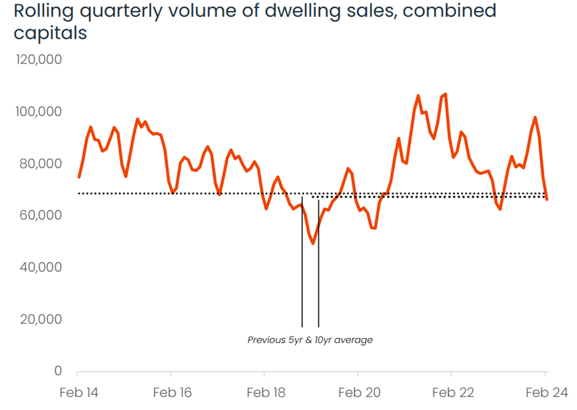

Sales Volumes

Despite high interest rates, cost of living pressures and low sentiment, purchasing activity ramped up through 2023, tracking well above average levels for most of the year.

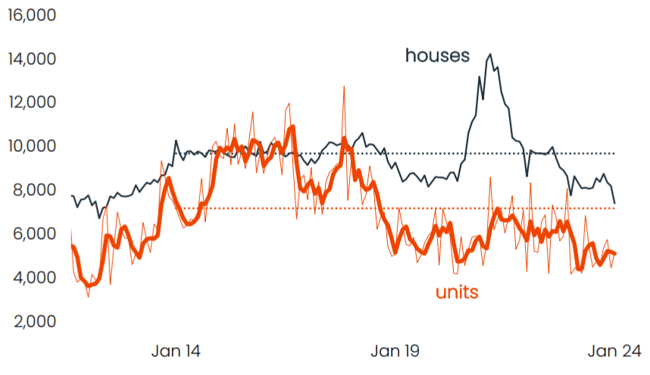

Dwelling approvals

Following the expiry of the HomeBuilder grant, house approvals have dropped sharply to well below the decade average. Medium to high density approvals have mostly held below average since mid-2018. The gap between underlying demand and approved supply is widening significantly… a substantial undersupply of new housing over the next five years is a potential outcome.

Monthly house vs unit approvals, National

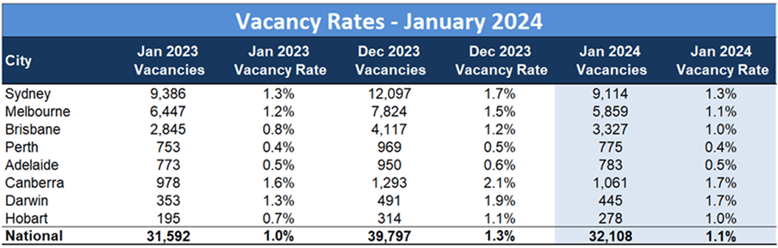

Vacancy rates

The rental squeeze continues and clearly reflected in the figures showing an average vacancy rate across the nation at just over 1%.

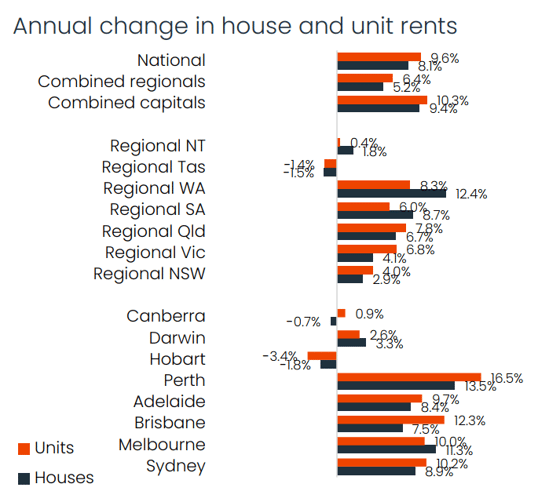

Rental increases

Rents continue to rise at a rapid pace, with growth in house rents re-accelerating in 2024. Rental growth across the unit sector is slowing, but from an extremely high level, reflecting a slowdown in net overseas migration and reforming group households.

Considering the Buying Opportunity:

The next 6-10 months will provide a unique window of opportunity for smart buyers to be early movers for their next property purchase.

1. Higher interest rates creates economic pain

With mortgage repayments now at substantially higher levels, people's savings are being diminished at a rapid rate which is causing widespread mortgage stress and financial pressure. This in turn leads to many owners selling their property to reduce their debt levels. Even if one or two rate cuts are delivered by the end of 2024 it could be too late for some mortgage holders who are financially stretched. This provides opportunities to buy from highly motivated vendors.

2. Fear and Uncertainty

Buying during uncertain economic times typically delivers the best opportunities. I have personally found that buying during difficult economic circumstances like 2008 GFC and more recently during the COVID period, delivered multiple opportunities to expand my property portfolio. During these difficult times there are more motivated sellers, who are therefore more negotiable on price. The majority of the population sit on sidelines waiting for the market to crash or for the ideal conditions and that never eventuates.

3. The next boom is coming

Several interest rate cuts are coming – it’s just the timing that is unknown. We have reached the peak of the current interest rate cycle and CBA recently predicted there will be six rate cuts before the end of 2025. The first rate cut is fully priced in by financial markets for September 2024 (however if inflation continues to decline at the current rate I'm predicting the first cut will come in August). When these cuts actually occur, it will dramatically re accelerate the property market. The cost of borrowing will decline which then improves available finance for buyers across the board. Expectations of interest rate cuts will improve consumer confidence.

4. More Choice

We're starting to see a larger number of listing volumes come back into the market. Last year listing volumes were down 25% but we are now seeing listing volumes normalise giving buyers much greater choice which swings conditions back in the buyer’s favour!

5. Low Building approvals

We have a structural deficit in the supply of properties in Australia. As noted before, dwelling approvals are currently at decade average lows for both houses and apartments and the trend line is moving lower due to significantly higher construction costs, difficult planning laws and lots of NIMBYism in local council areas.

6. Record low vacancy rates

We will continue to see the rental crisis unfortunately play out over the next 5 years as local state and federal politicians debate which policies will help fix the issues. Meanwhile, population growth and migration will outstrip housing supply and put pressure on already low vacancy rates. This is very positive news if you are a property investor as rents will continue to rise making stronger yields (not great news if you are tenant).

Taking Action:

I'm recommending that to all our clients not to wait three or four months to just see what happens, but instead be early movers before the competition really starts to ramp up. Instead of competing with say 2 or 3 genuine bidders at auction now, you might be bidding against 7 or 10 bidders in the later part of the year.

It's crucial to weigh the potential benefits and risks based on your individual circumstances. If you're considering buying, act proactively before competition intensifies. Contact our experienced team of property buyers' advocates for personalised guidance and support in navigating the current market.

Click here to get in touch with the Propertybuyer team:

or call 1300 655 615

.png?width=719&height=405&name=Market%20Update_March%20(1).png)

.svg)

.svg)

.svg)