Interest Rate Impacts: The Lag Effect - November 2022

November 13, 2022 / Written by Rich Harvey

By Guest Blogger, Pete Wargent,

Next Level Wealth

The lag effect

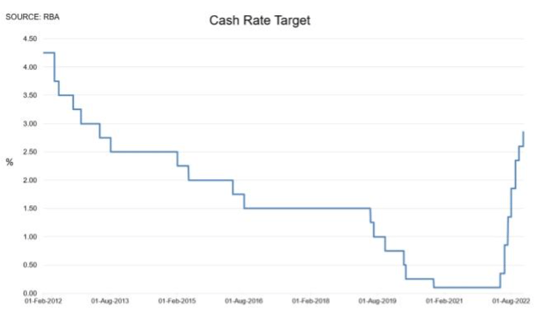

Australians have been hit hard with seven successive interest rate rises this year.

The Reserve Bank had previously expected to see the cash rate stuck close to zero until 2024 at the earliest.

And yet between May and November we’ve seen a dramatic U-turn in policy to tackle inflation, which has partly been driven by the Ukraine conflict, on top of existing global supply chain issues.

How long does it normally take before each interest rate hike filters through the economy?

It used to be said that the impacts of a change in interest rates would substantially be felt over the following 12 to 18 months.

You could argue that in the housing market the full impact of a rate cut or hike might not even be seen for an even longer period.

For example, if off-the-plan apartment sales are solid enough that an apartment project attracts a green tick, a medium-density development still might not be delivered to the market for 2 to 3 years.

But if sales are slow and development projects are mothballed or scrapped, there can be a very long period of time before new housing supply begins to pick up meaningfully again.

Hikes beginning to work

As such monetary policy operates with a lag, and the interest rate hikes delivered to date will in time work to cool demand in the economy and reduce inflation back down from around 8 per cent towards the 2 to 3 per cent target.

Already we are seeing the impacts, including drops in building approvals, new homes and off-the-plan apartment sales, construction loans, and lending for housing.

The economy has barely added any jobs on a net basis since June, and the unemployment rate has bounced off 50-year lows with a range of building and development firms sinking into insolvency.

Rapid hiking cycle

The current pace of monetary tightening hasn’t been matched by anything we’ve seen since 1994.

And there is likely to be more tightening to come.

At the time of writing the cash rate target has increased from an all-time low of only 10 basis points or 0.10 per cent to 2.85 per cent between May and November.

A further 25 basis points hike is expected by market pricing in December, which would take the bank rate to 3.10 per cent, which would be the highest cash rate target in a decade.

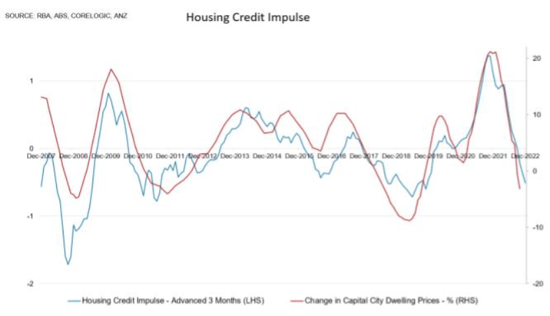

The pace of growth in housing credit is now slowing, and we know that historically this so-termed ‘credit impulse’ is the key driver of housing prices.

Depending on how much further interest rates are lifted, this suggests that housing prices may have a little further to fall yet.

Impacts to date on the housing market

What has been the current impact of all the right rises to date on the property market?

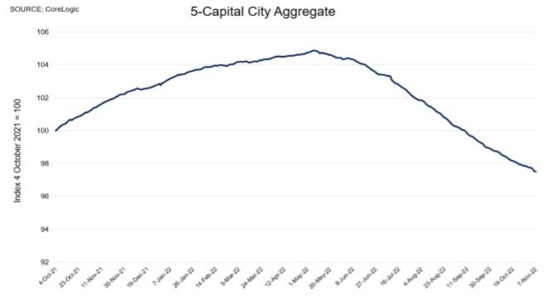

At the 5-capital city level housing prices have declined by around 7 per cent from their May peak.

Of course, this comes in the context of an increase of 20 to 25 per cent through the pandemic (and more in some parts of the housing market).

As such, this decline may not be such a surprise given what’s happened over the past six months to inflation and interest rates.

Fixed rate cliff and mortgage stress

To what extent have borrowers experienced mortgage stress as a result of the increases?

Surprisingly perhaps, to date lenders have actually reported declines in mortgage arrears and delinquencies.

This is largely because we have full employment: there is effectively a job for everyone who wants or needs one, and there are more hours available for workers.

We also have record low vacancy rates, and rapidly rising rents.

But remember interest rates work with a lag, and there will be some stress.

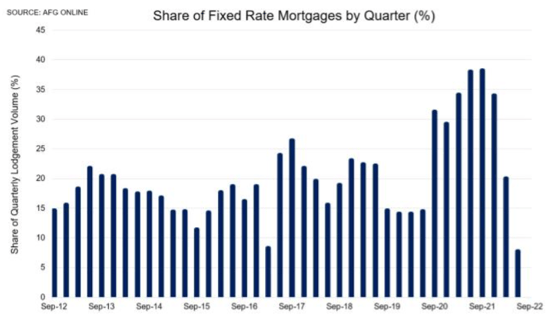

We had 18 months where Australia experienced extraordinarily elevated levels of fixed rate mortgage lending between the September quarter and the end of December 2021.

Many of these loans were written at 2 per cent or lower mortgage rates and given the most common tenor or fixed rate mortgage in Australia is two years, any are beginning to reset now at mortgage rates of around 5½ per cent.

The share of loan balance on fixed rate mortgages dropping from a record high of nearly 40 per cent back towards the historic average of 20 per cent is going to cause some tremors and will reduce household consumption, which is one of the ways in which monetary policy works.

Few forced sellers

Despite this, to date there are very few signs of forced sales, with most owners opting to sit out the downturn.

Indeed, total property listings for this time of year are at their lowest level in years.

On the buy side many prospective buyers are cautiously sitting on the sidelines and listening to the Reserve Bank rhetoric for signs that we’re approaching the terminal cash rate for this cycle.

It’s a narrow path that the Reserve Bank needs to tread, using some tough language or ‘jawboning’ to caution consumers that inflation needs to come back down in a timely manner, but not taking interest rates so high that a recession ensues.

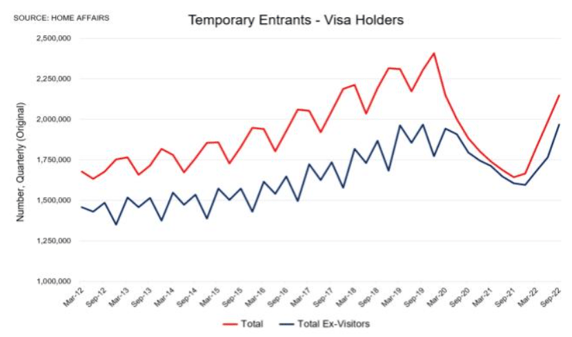

One other point of note is that the number of temporary visa holders has come rocketing back, increasing by 503,000 over the year to September.

This is another supply response which will help to tackle capacity constraints in the labour force and bring supply and demand back into balance over the next few months.

Numbers in the Federal Budget suggested that we may see Australia’s population increasing by 3 million – from 26 to 29 million – by the end of 2030, which will equate to a huge demand for housing over the decade ahead.

To have one of the friendly Propertybuyer Buyers' Agents to contact

you in regards to buying property :

call on 1300 655 615 today.

.svg)

.svg)

.svg)