How to Predict the Property Market - December 2021

December 21, 2021 / Written by Rich Harvey

By Guest Blogger, Pete Wargent,

Next Level Wealth

Time or timing?

It’s often debated whether time in the market is more important than timing the market.

There’s no definitive answer, but of course the ideal outcome would be ‘both.’

Time in the market can allow compound growth the time to work its mathematical magic.

But if you can add some strong market timing then this can help you to achieve more sooner, potentially allowing you to grow your property portfolio and wealth more efficiently.

Many people try to outsmart the market and pick the perfect time to buy.

Some believe you should always buy as soon as you are able to.

Others still are far too cautious and are forever procrastinating or waiting for everything to be ‘just right’…which, of course, it never is .

Buying now or later

Do you believe in trying to time the market?

The opportunity cost of waiting can be high and many miss the boat.

Just think back to what even many of the top economist experts were predicting in April or June 2020, which was substantial market declines which never transpired.

In fact, we got exactly the opposite and many prospective buyers missed out completely.

For first homebuyers there is a chance of being stuck renting for years when the opportunity to get in the ladder is not taken.

That’s a risk especially in the most expensive markets, such as Sydney, where prices have continued to rise fairly relentlessly over time.

Or is it better to buy well once you can get mortgage pre-approval?

Would you prefer getting in now and letting capital growth over time do the heavy lifting for you?

What do you believe are the pros and cons of waiting versus buying now?

No one size fits all

There is no one right (or wrong) way to do property buying or investing, and you have to choose how to chart your own course.

What else can buyers to get a ‘read’ on the market conditions?

There are more statistics and market research tools available than ever before, which can certainly help to understand market dynamics.

But even then they don’t always help even the best analysts to get the market timing right.

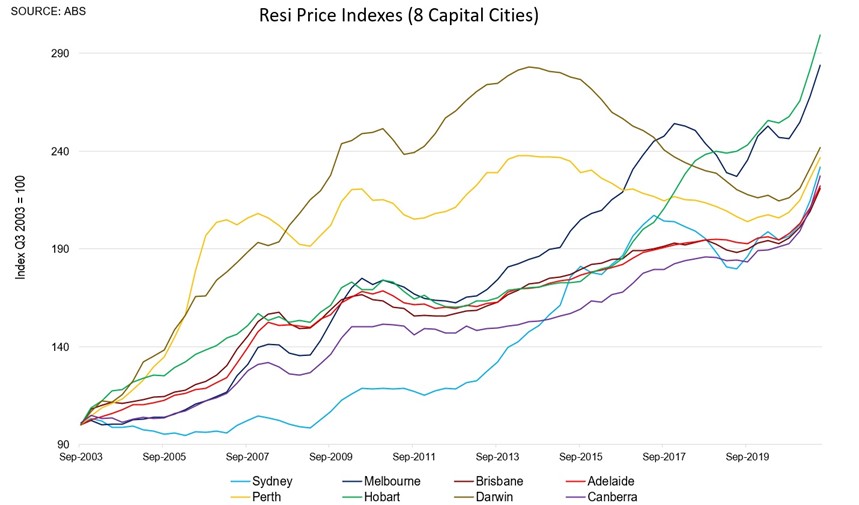

Let’s take a look at the Australian Bureau of Statistics residential property price indexes, disaggregated by capital city - from its inception in 2003 through until June 2021 - to see what we can learn about market cycles.

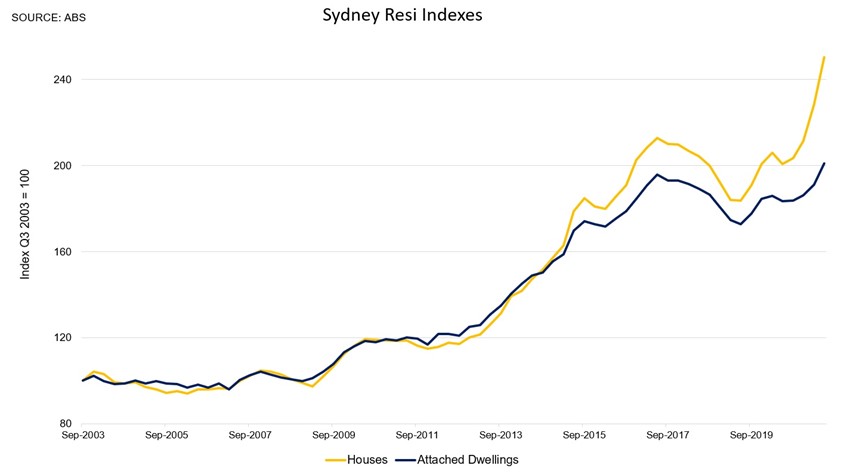

A first observation is that the ABS indexes commenced in the second half of 2003, right at the peak of Sydney’s post-Olympics boom.

So for the first 5 or 6 years of the index the Sydney property market more or less went nowhere (though naturally some suburbs and property types fared better than others).

Markets can go sideways for quite a time, and occasionally a long time.

That’s not ideal, obviously, and Perth did the same from around 2007 onwards for many years.

A second observation is that even if you bought at the absolute peak of the market in Sydney in 2003 you’d still have experienced capital gains through to the end of calendar year 2021 of approximately 150 per cent, following several strong periods of capital growth.

Including the leverage typically used in property bought with, say, a 20 per cent deposit, that still represents a fantastic return on investment over less than 20 years (given that a $500,000 purchase made in 2003 would likely have a market value of nearer $1.25 million today).

A third point of note is that although the various markets experience boom periods at different stages, over time the returns by capital city can be more similar than you might expect.

In fact from 2003 to 2021 the top performing capital city was also the cheapest at the outset: Hobart in Tasmania.

There are no definitive answers, here.

But ideally investors should look buy scarce assets in landlocked suburbs when they can afford to do so, and if they can successfully employ even an intermediate level of market timing than that should also help to improve the results.

But actually over the long run, acting when you can afford to do so may be what really counts.

To have one of the friendly Propertybuyer Buyers' Agents to contact

you in regards to buying property :

call us on 1300 655 615 today.

.svg)

.svg)

.svg)