House Prices Bottomed Out - May Market Update

May 1, 2023 / Written by Rich Harvey

By Rich Harvey, CEO & Founder, propertybuyer

Written by: Rich Harvey, CEO & Founder

propertybuyer.com.au

Click here to watch Rich's Video

- Population growth exploding

- Rental crisis to get worse

- Demand for affordable property intensifies.

As we head through autumn into the winter months, there’s a notable change in the property season too.

I believe we are moving beyond the bottom of the market now. Despite interest rates rising rapidly to curtail rampant inflation, the demand for property is being driven by supply side constraints. We are seeing more enquiries for our buyers’ agent services and more buyers at open house across all price points. Auction clearance rates are holding very steady around 70% to 75% in Sydney and Melbourne as buyers fight it out for limited stock available.

Stock Levels and Consumer Sentiment

Stock levels are currently down around 25% on the five-year average which makes for challenging buying conditions – and one of the reasons we particularly target off-market sales to give our clients an advantage.

Consumer sentiment rose rapidly in April surging 9.4% in the month, up from 78.5 to 85.8 points (Westpac Melbourne Institute). This was largely driven by the RBA’s decision to pause its rate hike cycle – suggesting that it has done enough for now. We may or may not see a final rate rise in early May.

Another leading indicator is the “Time to Buy a Dwelling” which rose by 8.7% in April as measured by the Westpac Melbourne Institute Index of House Price Expectations. This index has now lifted by a stunning 16.7% to now be 43% above the recent low in November last year according to Bill Evans, Chief Economist at Westpac.

Price rises and falls

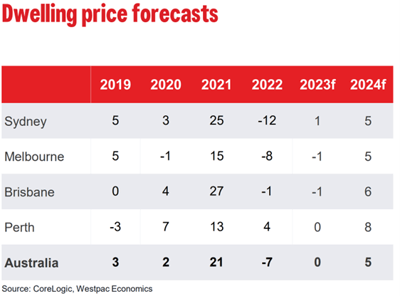

A noticeable trend to come out of the rate pause last month was the rapid revision of property price forecasts by the major bank economists. Many economists had predicted a 20% to 25% fall in peak to trough prices and now they are de-escalating their bearish forecasts to suggest a 10% to 12% overall peak to trough decline and forecasting we will see the market stabilise and then moderate increases for the remainder of 2023 and into 2024.

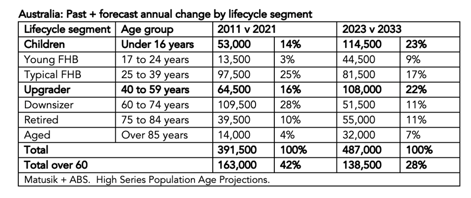

One of the biggest factors driving property prices in this current season is population growth – underpinned by surging migration into Australia. A recent analysis of population forecasts by Matusik has shown that the annual population growth rate over the next decade is likely to be higher than the past decade: 391,500 per annum between 2011 and 2021 versus an estimated 487,000 each year between 2023 and 2033 (See chart below).

Is population growth the silver bullet?

This means population growth over the next decade could be 24% higher than the past 10 years with an extra 95,500 people each year that all need housing.

Where’s the best investor buying?

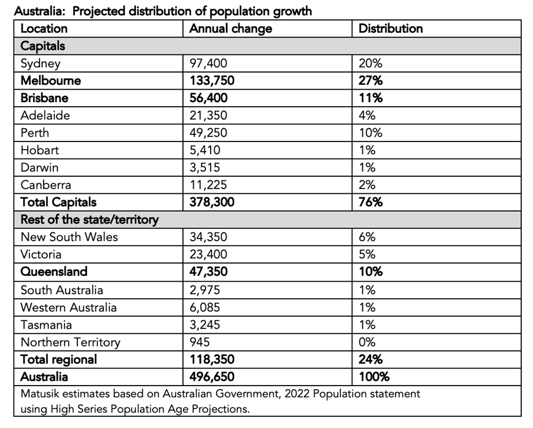

When thinking about where all our additional population could end up living, the chart below has some estimates of the distribution, showing the majority are likely to continue moving to the major cities of Sydney, Melbourne, Brisbane and Perth. But I agree with Matusik’s suggestion that the estimate for Brisbane is too low and for Melbourne too high.

The surge in migration numbers has seen vacancy rates falling to historic lows and rents rising in all major cities. The queue for rental properties is not something we have been used to seeing.

Wherever the new migrants decide to live – we are going to see greater pressure put on existing infrastructure and housing policy will need to keep up. If you think the traffic is bad when school holidays end, then just wait until our population has ramped up a few more million! For home owners and property investors already in the market, this data pointing to a bigger Australia, should give you greater confidence in the fundamentals of the property market being a super solid investment strategy.

Impact of Construction Costs

Another critical factor stifling supply is the spike in construction costs which have risen 20% to 30% or more during 2021-22. The replacement cost to build a house has risen sharply, which means that the intrinsic value of an existing home has also risen (and when you consider the overall market dropping say 12% but the value of your home’s physical construction has increased 30% - then you are still well ahead).

Borrowing Capacity

Now affordability and borrowing capacity will be the most talked about factors by the media in where the property market is heading. There is no doubt that higher interest rates have scaled back borrowing capacity substantially – but buyers are still getting approvals and using their buffers to get a bigger deposit in place to reduce interest costs.

Where to from here?

The RBA will be watching the inflation figures like a hawk and may pull the trigger one more time if they think it’s warranted to pull it back in line. This will have a temporary negative impact on consumer sentiment.

The only way for the property market to normalise (or equalise if there is such a thing as it’s always moving), is that supply of property must increase - both from new listings of established property and from construction of new dwellings. In the absence of stock levels rising, the obvious outcome is that rents will continue to skyrocket another 10% to 15% this year and that housing prices will also commence rising moderately. Far better to be in the property market than watching from the sidelines.

.svg)

.svg)

.svg)